Jagdish N. Sheth, Professor of Marketing, Emory University | Rajendra S. Sisodia, Associate Professor of Business, George Mason University

History

Nearly a century ago, Italy’s Guglielmo Marconi transmitted the first radio signals. Fifty years later, AT&T’s Bell Laboratories invented cellular technology. However, even ten years ago, the cellular industry in the US was virtually nonexistent; commercial service on a wide scale did not commence until the FCC’s license Lottery in 1983. Today, cellular telephony is probably the world’s fastest growing major industry.

In a rare instance where a new technology’s have been wildly underestimated, AT&T’s Bell Labs a decade ago predicted that there would be a mere 900,000 cellular users in the U.S. by the year 2000. The cellular industry today has an estimated 20 million subscribers In the U.S. and 40 million worldwide. The U.S. cellular Industry’s growth rate “dipped” to 32 percent in 1992, but astoundingly rebounded to 46 percent in 1993. Growth in 1994 is controversially estimated at 30-35 percent; growth rates are even higher in many other countries.

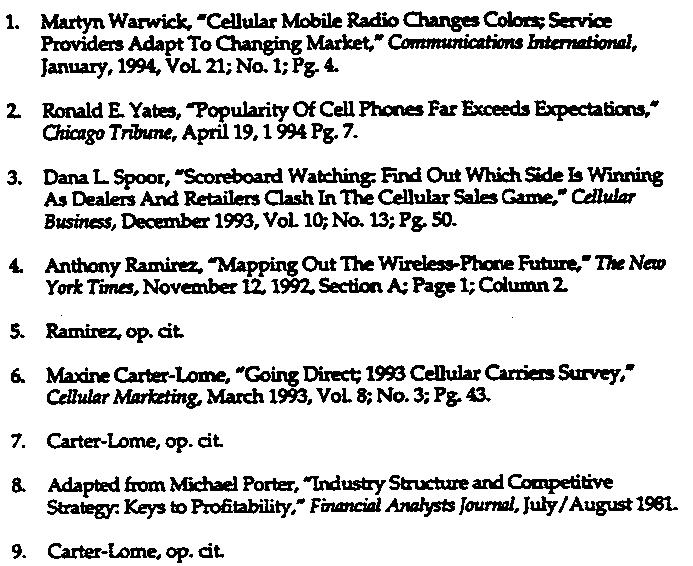

Table 1

Surprisingly, the first country to implement a cellular system was one the United States; rather, it was Japan In 1919, followed by the Scandinavian countries in 1961, and then the U.S. and several other countries In 1983. In 1965, cellular service was initiated in ten additional countries, including Hong Kong. Canada, Francs and Brazil From 1989 to 1992, almost all the countries In Latin America implemented cellular. Since 1991, many countries including several flout the Commonwealth of Independent States (the former Soviet Union), have been added to be International cellular arena.

Mobile Radio History

Cellular telephony has been arguably the most successful innovation in the last 25 years; certainly it has been one of the latest to achieve broad adoption. Cellular telephony has achieved its level of market penetration much faster than the microwave or the camcorder, and as fast as, if not faster than, videotape recorder to both cases, it only took nine years to reach the benchmark number of 10 million customers. By comparison, it took 22 years for fax machines to find 10 million customers; 25 years for cable TV, and 38 years for conventional phones.

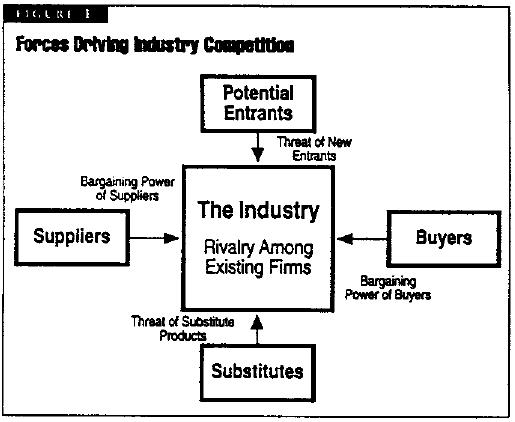

Despite its stunning growth so far, we believe cellular communications has an even more spectacular future. iN number of people who have so far been touched by this and other wireless technologies remains a small fraction of the population, even in developed countries. By 1998, the industry is widely expected to have well over 100 million subscribers worldwide—an estimate we think is conservative. Huge growth will continue for years, even decades to come, as the technology for wireless communications gets better, more versatile, and more affordable. As a result of motorization and digitalization, cellular technology is evolving rapidly. The economics of the cellular business are now closely bed to the astonishing economic characteristics of semiconductors, suggesting dramatic improvements in price-Performance and form factors. Already, the internal volume of cellular phones has been cut drastically, between 1992 and 1994, the weight of a typical cellular phone fell by more than half. Accompanying this reduction in mass has been a precipitous decline in costs. For example, the cost of a handled cellular phone a decade ago was about 84.000, and pagers were about $450. Today, the prices of low-end portable cellular phones and pagers have dropped to less than $100. Many (if not moat) are given away for ‘free’ to Induce to sign up for service. Similar (though not as drastic) in price -performance for network equipment are fast driving the industry towards becoming a mala market provider rather than a service for the wealthy.

As a result, cellular technology will soon become a viable alternative to the local wired phone company. This transit ion, surprisingly to some, is already happening in some of the least developed countries of the world. According to Herschel Associates, the average per capita GOP of countries launching cellular service was $14,500 in 1984, and will likely drop to $600 by 1998. In other words, cellular Is fast becoming an affiliate, even economical alternative to a wire-based telecommunications infrastructure, especially for voice communications. If current technology evolution vectors continue, wireless technologies may well allow for interactive broadband (i.e., video) communications as well.

Table 2

Industry Strategies in the First Decade

As discussed above, cellular has had a brief but spectacular history. So far, the Industry has primarily been concerned with creating and managing growth It has focused on the following:

Creating Capacity

Throughout its short history, the cellular industry has focused on deploying infrastructure equipment as fast as possible- adding cells, Increasing density through sectorization, and moving toward digital technology.

The first commercial cellular System was built in Chicago In 1983. By 1985, cellular service was available in more than 50 of the largest MSAs (metropolitan statistical areas), encompassing more than half the U.S. population, In June 1992. the industry reached a milestone all 734 U.S. markets (as defined by the FCC) were being serviced by at least one of the two operators licensed in each market

The FCC originally allocated 40 MHz of frequency spectrum for cellular service (20 MHz to each licensee) it added another 10 MHz In 1986. Cellular operators, especially in large metropolitan areas, met growth in demand through continuous system construction and the Integration of new technology. A commonly used method has been cell-split, where a cell Is divided by adding more, its a powerful base stations. By the increasing the number of cells, the system operator is able to increase frequency reuse. Of course, there Is a limit to which this can be without introducing channel interference As a result, the industry slowly began a partial move to higher-capacity digital technology in 1993.

The cellular Industry is now making the transition from simply getting networks up and running to focusing on better managing Its operations and becoming more romped, profitable, and responsive to customers. Cost-efficiency hat been improved over time through the introduction of smaller and cheaper base stations, and the development of a more intelligent infrastructure. By lowering its costs, the Industry is inching toward greater profitability.

Rationalizing Territorial Coverage

At the outset, the cellular Industry was highly fragmented, especially on the non wireline side. Few companies enjoyed economies of scale In network construction, operations, marketing, or customer service. Companies survived and grew year-to-year by targeting those customers with the greatest willingness and ability to pay its extremely high tariffs.

However, the business model for the cellular Industry is now fast moving from on based on high margins and low volume to a low-margin, high-volume one. This makes it Imperative that cellular companies lower their cost of opera bone. Many companies are achieving coat savings through the acquisition of regional dusters of operating licenses and the consolidation of high density markets in particular, allowing for efficiencies in network operations and marketing. This strategy has been followed by most of the large cellular operators in the country.

On the wireline side, the company that has achieved the most in terms of efficiency Improvements is Southwestern Bell, which averages $405,000 in revenues per employee (double the industry average) and 600 subscribers per employee (also double the Industry average). The company also has the highest penetration rate of the RBOCs, arid the largest number of subscribers. On the non wireline side McCaw moved early on to acquire other cellular companies and eventually became the largest provider in the world.

Even with all the consolidation that has occurred, the industry remains highly fragmented, and It Is likely that major consolidation (along the lines of the recently announced deals between Bell Atlantic and NYNEX and between U. S. WEST and AirTouch) will continue.

Moving from Local to Regional to National Coverage

Despite the movement within the industry to consolidate regionally customers have demanded more: the ability to use their cellular handsets outside their Companies have thus come under erroneous pressure to create seamless national networks especially since, the basic cellular Infrastructure Is now virtually complete.

The vision of a seamless system has been widely pushed by McCaw Cellular for a number of years. In this system, cellular subscribers in one region may “roam” in any other region and still use their phone in the same way. The Cellular One Group, led by McCaw, developed the North American Cellular Network (NACN), which operates with nationwide standards and provides a consistent level of quality. Customers are able to dial in many cities as though they were in their own calling area.

In response to the Cellular One NACN fifteen Canadian and U.S. wireline companies have put together a similar seamless national network under the name of MobiLink, Introduced in the summer of 1993, It now reaches approximately 83 percent of the population. Interestingly competes against its own members in some markets, since some phone companies have bought the nonwireline carriers outside their base operating region. For example, Pactel Cellular, a MobiLlnk member, has a presence In the San Francisco area, but the MobiLink licensee there is GTE.

Some RBOCs appear to be moving toward creating their own regional, even national wireless networks. Bell Atlantic has indicated Its interest in creating a nationwide network after its deal with NYNEX to combine cellular operations, Bell Atlantic suggested that it was looking for more planners so It can expand Its footprint to places like California, the Midwest, and the Southeast.

Creating Brand Identities

To achieve more seamless coverage from the customer’s viewpoint, the industry has moved towards creating greater brand Identity and fewer distinct brands. The cellular operations of several of the RBOCs, for example, now use” as part of their name. The wireline carriers have joined together to create the MobiLink brand. In response to the Cellular One brand, McCaw plans to use the AT&T brand, while the Sprint name will used for the PCS offerings being planned by a group of cable companies.

Targeting New Customers

As the pent-up demand for mobile telephony has been satisfied, cellular service providers are starting to aggressively target mass market customers, who are much more price sensitive. The early customer base was heavy users from business, especially owner-managed businesses. Increasingly, new customers are light users, and many are buying personal reasons. In 1988, 71 percent of cellular phones sold in the U.S. went to business users and 25 percent went to personal users, according to industry figures. By 1994, personal users accounted for 46.7 percent of cellular customers, while business buyers declined to 45.6 percent (government and law enforcement makeup the rest).2

Despite the rapid growth cellular service subscribers still account for only 10 percent of the U.S. population. The potential exists to greatly expand the market by making the service as affordable as basic wireline telephone service.

Expanding Distribution Channels

As it grew, the nature of marketing activities within the cellular industry changed rapidly. The primary target market has changed from mobile executives to a much array of users, including families and other casual users. The average monthly spending has declined steadily as such customers have become nines numerous. It became important to be able to acquire such customers at lower costs than those incurred through a heavy reliance on direct sales.

Reflecting this, the industry has moved from using only specialized distributor/dealers to using a variety of channels. Including mass merchandisers, direct marketers, etc. The use of third party distribution channels Is now widespread, and as the industry becomes more competitive, the importance of resellers continues to grow. This has greatly increased market coverage, but has also led to issues of hybrid channel design and management, and state problems with channel conflict.

In 1985, the typical US cellular subscriber generated $197 in revenues per month that figure is now about $70. The coat of acquiring new customers has been rising recently, from $400 two years ago to about $500 today. The challenge of lowering this acquisition cost has led the industry into new and innovative distribution arrangements.

The retail channel is expected to grow the fastest, as the consumer market grows in importance and the need to lower the coat of customer acquisition becomes more acute. Though growing in importance, the retail channel has thus far been mostly seen as complementary to dealers. The belief is that with new technologies coming In, many customers will feel the need to have access to specialists, while other customers will feel quite comfortable dealing with retail channels.

As third party distribution has grown in importance, the speed and convenience with which service activation can occur has become increasingly crucial NYNEX to working toward having every customer whether retail or dealer— activated within five minutes of the purchase. PacTel offers paperless activation, which takes only a few minutes. BrandsMart customers wait less than 10 minutes for activation at that company’s outlets.

Getting retailers to sell cellular service requires education and a mindset change. Cellular Is a completely different animal from (other products sold via) retail according to Faith Seiders, general manager of indirect distribution for BellSouth, Atlanta. The normal product allows the retailer to buy a box from a manufacturer, mark the product up to the appropriate market price and sell it. Cellular requires them to change their thought process and to buy a product from a manufacturer, mark it down, sell it to the customer, and accept commission on the back end. 3

Bundling Handsets and Service Contracts

Using the razor and blade’ analogy, the industry has achieved rapid growth by subsidizing equipment purchase with service contracts (except in California. where the practice is not allowed). This lowered the barrier to adoption, but also brought In many low revenue customers at high acquisition cost. Many of these customers are minimally profitable or cause the industry to lose money. Customer selectivity, retention, and efficient customer servicing have thus become key profitability drivers in the industry.

Relative Price Stability

Back in 1982, when the FCC set up rules for the cellular markets, the agency divided the country into 734 territories and permitted no more than two companies to operate in each region. The theory was that competition between two companies in each market would eventually bring prices down,4

In reality, the duopoly structure resulted in far less price competition than expected. Within at least two-thirds of the regions, the prices charged by the two cellular carriers have been found to be almost the same or even identical. The General Accounting Office, the investigative arm of the Congress, made that finding In July 1993, but said it could not learn why, in part because the Industry was not required to provide detailed revenue and coat data. Critics and some industry analysts charge that consumers are paying too much for service and are being forced to underwrite the billions paid by one cellular company to acquire another.5

In addition to the escalating prices paid for the acquisition of territories, especially by nonwireline players, another reason for continued high prices has been the reluctance of wireline providers to lower prices due to an expected substitution effect between wireless and wireless service. In Other words, if the RBOCS made cellular too affordable, it could cannibalize their bread-and-butter wire-based business.

Few U.S. cellular carriers have made any significant profits in their decade or so of existence. The high prices paid by the nonwireline providers for territories have had the impact of creating a profitable pricing umbrella for the wireline companies. Within the industry, only the latter have made any significant profits from cellular operations.

Prices are expected to come under severe downward pressure from two different sources in coming years. First, with network capacities expanding rapidly, more cellular companies are trying to induce greater usage at the low end, sometimes by bundling in discounted caning time along with the monthly fee. Second, the advent of PCS services will lead to a veritable price war as the aggressive new entrants attempt to buy market share and establish themselves in the market.

Competing on Quality and Reliability

As the industry has matured, customer expectations have soared. Users now want higher call quality, call completion wherever they roam, a high level of reliability, itemized, timely, and accurate billing, responsive customer service, and lower costs. Companies are competing fiercely on customer service, advertising, and distribution channels. They are also competing aggressively on enhanced service, suds as voice mail, fax cspabilib.es, etc. The cellular handset, which Is a far more sophisticated device than a wireline handset, incorporating a great deal of microprocessor technology, to rapidly shrinking ‘us its form factor, while adding advanced capabilities such as voice recognition, handwriting input, etc. CPE functionalities in turn drive the network, which must add capabilities to allow the terminal equipment to operate. Optional services features continue to grow in popularity. Among respondents to a survey by Cellular Marketing, all offer call waiting and call forwarding. Ninety-six percent offer conference calling, 92 percent offer busy-no answer transfer, 87 percent offer voicemail, 43 percent offer paging and traffic Information. 39 percent of weather information, 30 percent offer sports Information, 21 percent offer stock quotes, and 11 percent offer other services, including soap opera updates, ski reports, and horoscopes.6

Lowering the Cost of Doing Business

As competitive forces arid changing customer profiles put downward pressure on prices, the industry has been faced with the need to lower the cost of doing business. In addition to achieving operational and marketing efficiencies through the rationalization of territories, the industry has also worked to lower the cost of acquiring new customers. In part, this has been achieved through the deployment of new, lower cost acquisition channels, suds as kiosks in shopping malls (GTE) and grocery Stores (U S WEST New Vector). Carriers are also seeking to tie the cost of luring new customers to the revenues that the customer is expected to generate. This is being achieved through an agent’s Commission to the customer’s usage level. The formation of national brands is also seen as a way to lower customer acquisition costs.

It appears as if carriers are succeeding in this. According to Cellular Marketing survey respondents, the average activation commission paid is $174.26, down from $ 2U30 in the previous survey and $193.73 from the survey conducted in the beginning of 1992. The lowest activation commission paid is $20 versus a high of $400. In addition to tie commission fee, 52 percent of respondents say they are paying residuals (commission tied to a customer, usage level and longevity with the provider), versus 53 percent in the previous survey.7

Current Industry Competitive Structure

As discussed above, though the rivalry between competing cellular carriers has been quite intense at times, rapid growth and the duopoly structure of the Industry have kept competitive forces at a relatively low level In the Industry. That is changing rapidly.

The Competitive Analysis Framework

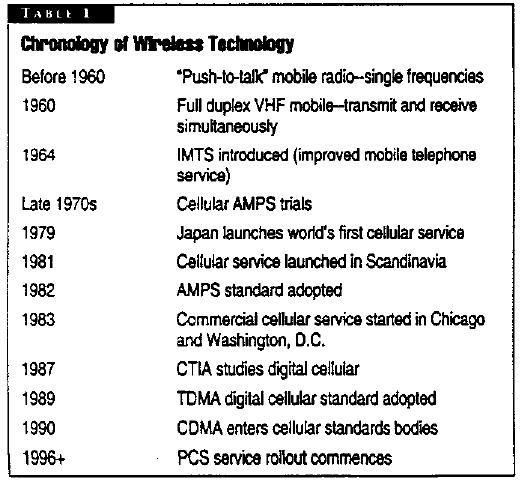

The framework used in this section for assessing the competitive environment is the well-known Five Forces model of industry structural analysis developed by Michael Porter and depicted in Figure 1. 1

Figure 1

This model has become an important strategic planning tool for many industries. The focus of structural analysis is on identifying an Industry’s underlying structure, apart from the many short term factors that can affect competition and profitability in a mote transient way. According to Porter’s model, there are five forces that affect competition in an Industry —

- Rivalry between existing competitors

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitute technologies

The strength of these five competitive forces reflects the underlying competitive structure of an industry. Having evaluated tie forces and resulting industry structure, a firm can then Identify Its own strength and weaknesses relative to the Industry. Where does it stand against substitutes? Against the sources of entry barriers? In coping with rivalry from established competitors?

All five forces determine the intensity of industry competition and thus profitability, but the strongest forces are crucial For example, even a company ins strong market position in an industry where potential entrants are no threat will earn low returns If it faces a superior, low-cost substitute. Even with no substitutes and blocked entry, Intense rivalry between existing competitors will limit potential returns.

The effect of heightened competition in an Industry is to drive down the rate of return. When tie rate of return falls below the yield on long-term government securities (adjusted upwards for the risk of capital loss), investors will not tolerate it for long.

Structural analysis cart be used to chart a future course of action. Companies cart use an adaptive approach, which takes tie structure of the Industry as a given and matches the company’s strengths and weaknesses against it. A more aggressive option, usually available only to large, even dominant players, is to use art alteration approach, designed to alter the balance of competitive forces.

In the following sections, we consider the competitive forces in the cellular industry using this framework.

Industry Rivalry

The degree of rivalry between incumbent players is standing to intensity. Rapid industry consolidation on a national level is leading to the creation of ever larger players. These players have enormous resources that they can bring to bear on customers and competitors. Further industry consolidation is likely, leading to larger rivals facing one another in every major market

The intensity of the fight for market share is reflected In the Increasing problem of churn (currently estimated at approximately three percent per month).9 Firms are competing especially aggressively for the acquisition of newer customer groups. At the same time, they are struggling to retain existing desirable customers.

Buyer Power

With greater competition will come greater customer choice. The power of buyers is thus rising; this includes both end users and intermediaries.

Channels – As discussed earlier, the trend in the industry is toward the increased use of third party distribution channels and away from dealers and internal sales. This transition will lead to lower costs for acquiring new customers, but it will also result in a reduction in control over the selling process and the customer base. Large new retailer customers, such as Wal-Mart and Circuit City, have enormous buying power and sophistication. They will use their bargaining power shrewdly.

Corporate Accounts – Until now, moat corporate user, have really been Individuals acting on their own. As procurement specialists get involved in acquiring wireless capabilities, they will be much more sophisticated and demanding customers. As they have done with telecommunications services, they will try to manage and control the communication resource more centrally. As the technology moves towards digital, data processing managers will become more important.

End Users – Users today are more accustomed to higher quality service and better value. They now have higher expectations and are less tolerant of poor service, low technical quality, etc.

Supplier Power

The cellular industry has two kinds of suppliers: those manufacturing terminal equipment (band-sets) and those providing Infrastructure equipment. More suppliers are starting to specialize for example, Motorola is Increasingly focusing on terminal devices such as pagers and cellular phones.

In the short run, due to a shortage of certain components (such as semiconductors), manufacturers of terminal equipment appear to have some power over cellular operators. In some parts of the world, customers are being put on allotment. There are also several different standards in use worldwide. This situation is not expected to persist in the long run, terminals will increasingly be built to world standards and will be largely interchangeable. Supplier power will thus be limited.

For infrastructure equipment, we believe the reverse to be true. In other words, Infrastructure supplier power low in the short run, since a large number of competing vendors are attempting to establish greater market presence. However, we expect that there will be a shakeout In the Industry in years to come, and only a handful of suppliers will survive as major players. Greater consolidation in the already globalized infrastructure equipment business will lead to a smaller number of major suppliers, potentially increasing their advantage over the still-fragmented cellular Industry.

Also, we believe that in the long run, suppliers to the cellular industry have no particular loyalty to cellular service providers. They will took more broadly to the wireless industry, and at opportunities such as wireless cable, wireless PBX, digital cordless etc Given their ability to serve the needs of cellular rivals, often with superior technology that does not have to factor in an installed base of users of previous generation technologies, the power of infrastructure suppliers is Likely to increase.

Threats of New Entrants

There are a number of markets where already-licensed cellular operators have yet to commence operations. Some of these will initiate service in the next few years. Other than these, there will be no new entrants in the cellular business, as the duopoly structure remains firmly entrenched. However, new player, axe coming into the industry through acquisitions (e.g. AT&T-McCaw) or mergers/joint venture (e.g., Bell Atlantic-NYNEX; Airtouch U.S. WEST). These players will bring different cultures and much greater resources to the Industry.

Threat of Substitute Technologies

As a result of technological change, the Industry definition is expanding from the cellular industry (predicated on today’s cell-based technology) to the wireless Industry (Independent of any particular technology or architectures. This change is coming faster than most people realize.

Several technological vectors bear watching

Digital cellular technology — Digitalization has several important benefits for wireless communication provider. First, it enables the provision of multimedia services on the same platform, since digital bits do not distinguish between different types of Information (audio, text, data, etc.). Eventually, this will allow for wireless interactive, video capabilities as well. Digitalization also adds features and capabilities not afforded by analog technology, such as number identification. Though high upfront costs are involved in making the transition to digital technology, this is offset by greater reliability and capacity and lower maintenance costs, resulting in lower life cycle costs.

Capacity efficiency technologies, i.e., compression – The ability to compress information is an Important by-product of digitalization. Various compression approaches are bring developed, whirls offer up to a ten-fold improvement us the efficiency of spectrum utilization.

Enhanced specialized mobile radio (ESMR) – This new technology, developed by Motorola, enables providers of dispatch-type services to offer cellular-style communications, adding paging and data capabilities as well.

Personal communications services — Cellular was primarily designed as a narrowband, voice channel technology primarily for drive-around applications. PCS will be digits] from the outset, and may eventually have broadband capability. The expense of building a PCS and technological advances its the cellular alternative raise the question of whether PCS represents a true threat.

Declassified military technologies – Many cutting-edge wireless technologies were previously directed exclusively for military applications are now becoming available for commercial application. For example, Hughes Electronics is leveraging Its defense Industry experience in satellite technology to enter a number of communications business. Likewise Steinbrecher spread spectrum technology offers impressive promise for digital wireless communications.

VSAT (very small aperture terminals) – VSAT systems already heavily deployed In the specialty retailing business and their capabilities are being expanded continuously by sophisticated suppliers such as Hughes and others. VSAT systems will carry a lot of data that aught otherwise be carried by cellular systems using cellular digital packet data, they may soon add voice functionality as well.

Satellite technology – A number of satellite-based wireless telephony projects have been announced, including Motorola and partners’ Iridium, TRW’s Odyssey, the Teledesic project proposed by Craig McC.aw and Bill Gates and the Hughes Communications-led American Mobile Satellite Corporation. While these projects all have their skeptics, they do o the potential of significant competition for traditional wireless players.

Conclusion

The first decade of the cellular industry has been eventful indeed, and we believe that the industry has many years of growth ahead. However, the next decade will see major competition in the wireless communication arena, many new technological advancements, and continued opening of world markets. In the next paper, we lock at the forces that will drive the evolution of the cellular industry in the next decade and beyond.

Notes