Robert Janowiak, Jagdish Sheth and Massoud Saghafi | Technology, globalization, convergence and competition will have significant implications for the future information industry.

Over the next one to two decades, the worldwide telecoms industry and its broadly based parent, the information industry, will undergo massive change. Privatization of PITs, regulation encouraging competition, and the issuance of wireless spectrum licenses are driving industry infrastructure and restructuring. What will be the dimensions of the new information industry? Which drivers will be the most significant in industry convergence? What will be the societal, economic, and trade impacts? How can traditional telephone, cellular, personal communications services, and cable companies thrive in the new information age?

These compelling questions are the basis of research studies at the International Engineering Consortium, University of Southern California’s Center for Telecommunications Research, and the Institute for Communication Research and Education. The studies have included fundamental research coupled with thousands of executive and other expert interviews, looking at changes over the next decade and beyond.

Driving Convergence

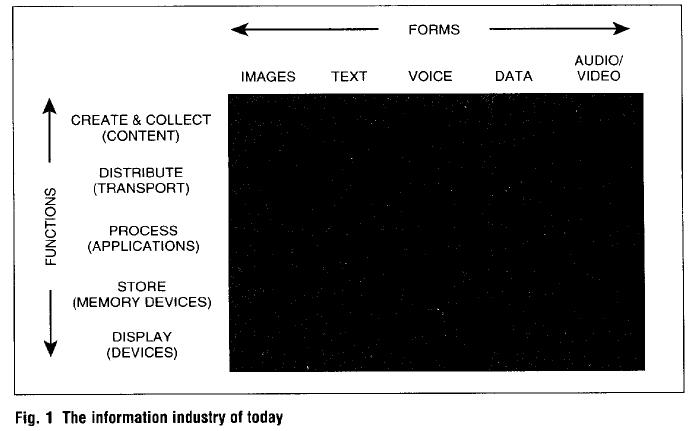

The information industry has traditionally been defined in terms of the ‘form’ of information (Figure 1) and the underlying technologies for handling each type of information, including images, text, voice, data, audio/video. Each form must perform a series of functions, including creation, distribution, process, storage and display, to ultimately serve its markets.

The primary driver of convergence of these different forms of information is clearly technological change. And the key technological change has been the rapid diffusion of digital technology into an ever- wider array of information businesses. Beyond digitization, dramatic changes in the computing and telecoms industries are also driving convergence.

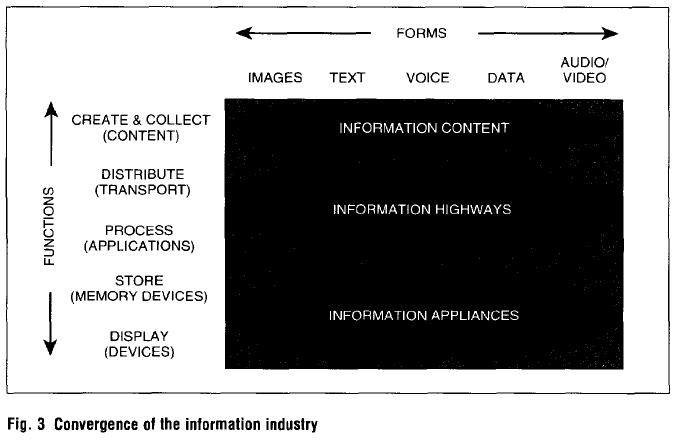

Compared with earlier forms of applications, there is a large fixed cost in digital technology (Figure 2).

The development of a chip and investment in plant costs billions of Fig. 1 The information Industry of today dollars. Software developments may cost hundreds of millions. The marginal cost of chips and software is very small. The impact of these economics is low selling price potential to mass markets.

Digital technology also promises even greater change of a discontinuous nature. This phenomenon will enable interactive multimedia and video information to come into every household in various ways — through the air from satellites and terrestrial wireless systems, through fiber-optic cables and cable television, and even phone- company coaxial cables.

- The impact of the migration of the industry towards digital electronics will he structural:

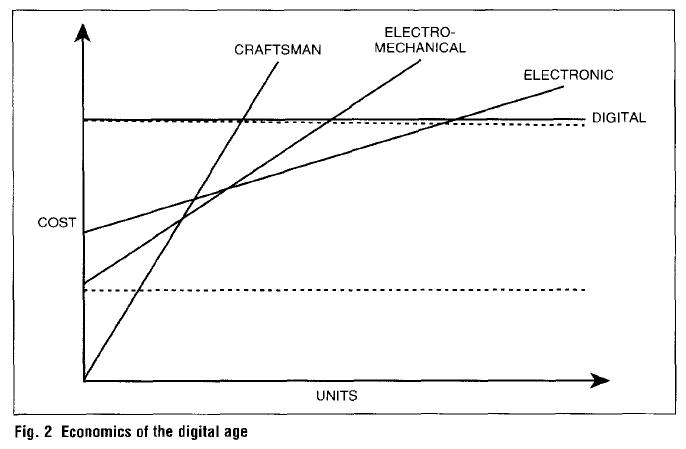

- the industry will reorient itself across the various forms of information (Figure 3);

- there will be a series of intra-industry and cross-industry consolidations as major industry players position themselves (or the future, based on a chosen functional specialization;

- the transformation will result in only three major industries (not five), which suggests that it is going to become more efficient in the process. The three industries will be providers of digitized content, multimedia dev ices, and convergent networks.

Companies that thrive in the future will therefore have:

- a bias towards personal rather than institutional markets;

- greater expertise and experience with digital electronics;

- a functional edge — outstanding expertise in performing one of more information functions;

- more experience with video-based information, since technologically, other forms of information arc subsets of video.

In addition to the functional basis, three key factors will characterize the evolution of the information industry in coming years: each new industry will be multimedia in nature, global and will become increasingly driven by a model in which personal markets rather than institutional markets will lead technology deployment.

Public telephone networks, cable television, broadcast media and private networks will 1w consolidated into the information and transport business. These players will provide broadly-based communications arid content in a variety of forms that meet the specific needs of free markets they serve.

The nerve system of the future information industry, indeed of the future global economy, will be a communication network of enormous capacity and sophistication. By the year 2010, a global economy of virtually infinite capacity will be in place. It will be a network of networks consisting of multiple, overlapping and inter-connected webs that collectively will realise the promise of huge two-way bandwidth to virtually every mode.

During the next 10-15 years, convergent technologies will lead to worldwide end-to-end voice, data, fax, video and image services. These services will begin between hub cities and work their way towards suburban and rural areas, much as the way telephone service did in the 1920s and the 1930s. The global network of networks will be both a transparent communications service and a platform for content-filled or content-enhanced services.

Consumer electronics companies and personal computer manufacturers will converge into the multimedia devices (information appliances) industry. As the PC gets more passive (receiving video streams like today’s televisions) the television will get more interactive; hence the convergence. The convergence of the telephone, television and computer will lead to hybrid dev ices that combine the strongest features of each.

Competition

The research has found that in the U.S. alone, long-distance telephone revenue is expected to grow to U.S. $100 billion in 10 years. Local exchange revenues, including access charges, will reach U.S. $120 billion by 2007. The average monthly bill of a typical American household is expected to rise very slowly over time from its current U.S. $20 level to only U.S. $25 by 2007. Over a 10-year period, the bill for Local charges are expected to rise merely by 25 per cent in nominal terms or by an average of half a dollar Adjusting for inflation, this amounts to virtually no real rise at all.

The combined local and long-distance bill of an average American family will reach U.S. $ 55 by 2007. This suggests that at the end of this decade, the long- distance part of the residential bill will grow just slight]y faster than total local. With the opening of the long-distance market to new competition and competition from wireless, the Internet and the utilities, long-distance rates will continue to be under pressure and margins are expected to further.

For business markets, the cost of voice communications for inter-city businesses is expected to drop by 5.5 per cent in the short run, by 10 per cent in the middle term and by 15 per cent in the long run. The competition, not only from other wireline providers, but from wireless and other alternative companies, will force down the business rates offered by telephone companies.

Similarly, in the US wireless market, total revenue generated is expected to reach nearly U.S. $ 50 billion by 2007. Wireless communications is expected to constitute 35 per cent of new subscribers for their voice calls at the end of the decade.

New users in advanced nations are likely to follow the American trend, with 30 per cent of them expected to be wireless by the end of the decade. The developing nations are building their modern communications infrastructure over the next 10 years. Experts predict that wireless transmission will constitute up to 50 per cent of the voice traffic by the year 2007. New users in developing nations, starting with a relatively primitive telecoms infrastructure, may resort to wireless as an expeditious and economical system for voice telephone traffic.

Economic Impact

The economic impact of the information age telecoms infrastructure will he immense, globally. The telecoms industry is one of the fastest growing sectors in practically every country and is expected to improve the US gross national product by two to four per cent.

Increased competition among service providers will lower rates, resulting in more usage. Convergence, leading to mergers, with the telecoms and information technology sectors will set off a competitive war with some employment and displacement in the early stages followed by significant economic expansion as new technology leads to new applications and growth. Increased global competition will force the less nimble companies to go out of business. Those effectively utilizing the infrastructure will be very successful.

The competitive position of the US will increase, helping the US gain larger market share on a worldwide basis. Since technology accelerates the pace of change and, in general, small business can change more quickly, small business growth and start-ups will continue. The ability to transfer data within and among enterprises improves collaboration between partners, reduces cost, improves quality, decreases cycle times and time-to-market and increases reliability of products.

Another explosive input to the economy will come with consumer ease of access to more avenues for spending disposable income. This will be generated from the child who can play video games with friends outside home, to the shopper with virtual mail, electronic stores, and catalogues that provide personalized shopping.

The information age will help to further facilitate growth in the services sector. Human resources required today to ‘hand-deliver’ information will need to be re-educated and redeployed, much as steel employees and farmers were in yesteryear. The public will not use the post office to mail their bills when they can do it electronically, nor will they want to pay the local phone company for dial tone.

The significantly large SOHO segment — with its need for videoconferencing, fax, PCs and telephones, all in the home and paid for by corporations as business expenses will help businesses save on office space with time share offices for employees. This will also help with child- care and elder-care responsibilities in addition to reducing commuting requirements, expense and pollution.

The market for telecoms infrastructure equipment will continue to grow, exceeding IJS$ 300 billion by the year 2000. The services that will be enabled by the infrastructure will be in excess of US$ 700 billion by the year 2000. Hundreds of companies wifi start to offer information products and services and millions of jobs will be tied directly to the telecoms industry.

Advanced countries will have access to vast new markets that today may be economically infeasible to access. Once an infrastructure becomes available, it allows global access to consumers, resulting in an increase in trade volume. Information can be delivered to more people and more places. Intellectual services will be available from anywhere at any time. As the trade barriers fall, rate cuts will follow and the number of services provided will increase.

Developed nations will have access to and will be able to use their massive telecom and information infrastructure to improve their economic well-being and trade status. The developing nations on the other hand, will not be able to participate and the gap between the advanced economies and the less dev eloped nations will widen. Since the ability to produce at lower cost will be tied to both information technology and the infrastructure on which it rides, nations with more advanced users’ and structure will mostly benefit.

The Future Telco

Fall-service, full-content, fully interactive organizations managing the vast majority of information and interaction with end users — emphasizing reliability, privacy, and tot al services — will emerge. Most plain old telephone service (POTS) providers are in other lines of business today. In 10 years, a POTS provider will make less than 50 per cent of its total revenues from wireline voice service, compared with more than 80 per cent today.

Mergers, acquisitions, and partnerships crossing every industry line is a sample of what the future will hold. AT&T has invested U.S. $ 12.7 billion in McCaw Cellular Communications and has acquired a number of technology start-ups — including game maker Spectrum, Holobyte, and General Magic, which is a consortium with three cable companies to enter the wireless market. British Telecom and MCI have recently announced plans to merge. The new firm plans to spend IJS$ 2 billion to build local loop telephone networks in 20 of the largest cities in the U.S.

Sprint teamed with three leading cable companies to acquire a large position in PCS licenses. Bell Atlantic and Nynex and Pacific Telesis and SBC have already beg un their historical merger process. Although these major changes amount to U.S. $ 50 billion, they represent only the beginning of a major repositioning of the information industry.

Cellular companies will be full-service providers, of- feting digital technology with near-nationwide coverage. They will provide local and long-distance services, wireless local access, fax, and paging services and will be low-speed data transmitters and billing management integrators. On one hand, economics will continue to favor wireline for volume users. On the other, the intense competition that is expected with the implementation of PCS systems and even satellite will force mergers among cellular companies and between cellular, personal communications, and complimentary wireline companies. Hence, the cellular-only companies may, by and large, become extinct Rather, they will be a component of a full-service company (cable, POTS, and long-distance). As standalone companies, they will serve very niche markets and will not be likely to survive in the long run as telcos and cable companies enter the wireless market.

The future of PCS services is, perhaps, more in doubt than any other area in the industry. Although billions of dollars have already been spent to acquire PCS licenses, the service is still unknown to the potential user, especially in the US. Furthermore, PCS is entering into an existing market that already has a number of wired and wireless alternatives with more on the horizon. These realities suggest that 10 years from now, it is uncertain whether PCS companies will gain a substantial foothold in the wireless market.

Cable companies, on the other hand, have plans to expand into other areas of the industry: telephone and data transmission in the broadband age. They are, typically, under-capitalized and, individually, hold a minority share of communications revenues. Only three to five per cent of major cable-only companies are expected to remain in their current form. Others will be acquired — telcos are interested in acquiring or establishing cable companies in their own regions for easier entry into broadband markets.

But the future cable operators will upgrade their infrastructure to become one-stop telecoms and distribution companies providing telephony, cable television, interactive video, video-on-demand, home shopping, on-line Internet access, gaming, telemedicine, and tele-education. Acting as enablers to other content providers, they will offer these services on a bundled or individual basis.