Few models are currently available to aid managers in their strategic market planning. The models or frameworks that do exist have a variety of shortcomings. This paper develops a planning model based on a firm’s targeted levels of margin and return designed to provide a partial foundation on which its managers can base their strategic market planning.

Introduction

A number of models or frameworks have recently emerged as tools for strategic market planning, such as the market share-growth matrix, the industry attractiveness-business strength screen, the PIMS analyses, and the strategic intelligence system approach (cf. Abell and Hammond 1979. Day 1977, Montgomery and Weinberg 1979, Wensley 1981). Although these models and frameworks are highly interesting and useful as diagnostic tools, they suffer from two major weaknesses. First, they are not adequately linked to the primary corporate goals of maintaining an adequate net profit margin and return on investment, due either to questionable assumptions and use of surrogate relationships or to methodological problems. Second, and perhaps more significantly, these models or frameworks provide strategic recommendations that are either too general (e.g., harvest. grow, divest) or often difficult to implement (e.g., disinvest dogs).

This paper develops a model for strategic market planning using the corporate goals of margin and return on investment as its foundation. Based on whether or not an organization’s net profit margin and return both reach targeted levels, the model shows how different strategic objectives should be sought and how different strategies should be utilized to achieve the organization’s ultimate margin and return goals. It, therefore, attempts to alleviate two major weaknesses that exist in current models and frameworks dealing with strategic market planning.

The Margin-Return Model

The two most common financial goals of all for-profit corporations are maintaining an adequate net profit margin and return on investment The margin criterion reflects the company’s financial performance on specific business activities, It is directly related to the efficiency of the company’s purchasing, manufacturing, distribution and marketing operations. Perhaps the most important aspect of a firm’s margin is that it reflects the company’s cash flow position. The most common measure of net profit margin is the percent of sales revenue still remaining with the company after payment for all variable and controllable costs associated with its level of sales, such as cost of goods sold, operating expenses, short-term interest expenses and corporate tax. In short, the margin criterion reflects the financial impact of the firm’s short-term tactical and operational decisions.

A firm’s net profit margin will influence its return on investment. However, a firm’s return also reflects other important factors. First it reflects the company’s investment and capitalization policies and is generally indicated by the extent to which the company sinks capital into manufacturing, distribution, warehousing and human resources proportional to its level of sales. Second it reflects the company’s financial leverage decisions on issues such as its debt to equity ratio and the combination of various paper portfolios including common or preferred stocks, convertibles, bonds and debentures. Finally, it reflects die long-term financial viability of the corporation to sustain targeted growth and diversification objectives. In essence, the return criterion indicates the success of the company’s attempt to declare and stake out its future mission and objectives, whereas the margin criterion indicates the company’s present performance on strategic decisions made earlier.

The most common approach to measuring return on investment is the percentage recovery of capital assets (net profits divided by net worth) on an amortized basis (net present value).1 It is directly anchored to the life cycles and depreciation schedules of embedded assets in manufacturing and distribution, manpower and the property holdings of the company.

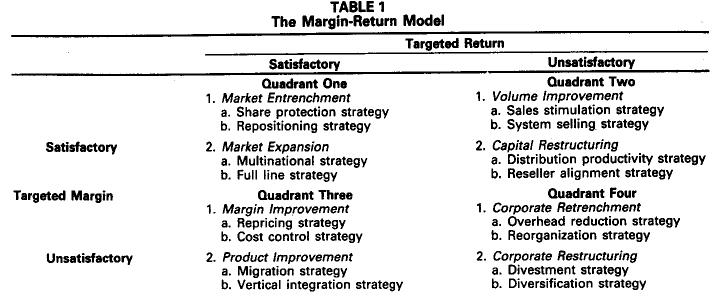

The margin-return model is presented in Table 1. The basis for the model is whether or not a firm reaches targeted levels on both its net profit margin and return on investment.2 Unlike the criteria utilized in the market share-growth matrix and the business screen analysis, the target levels established for satisfactory performance on margin and return arc generally well-established and fairly consistent over time. Most companies tend to set a target level of net profits as a percentage of sales to reflect operations efficiency and similarly a target level of return as a percent of the capital asset base to reflect cost of capital and dividend policies. As Rappaport (1981) argues, targets should be set to preserve shareholder’s value.

Current levels of margin and return can be inadequate indicators of the Organization’s actual value and probable future performance (cf. Rappaport 1981, Weston and Brigham 1972). For example, a firm’s present return could be low because several of its major products have required heavy research and development expenditures and are in the introduction stage of their life cycle. A dangerously high leverage ratio will inflate a firm’s return while increasing its future cost of capital and decreasing its future value as a result. Therefore, management should estimate what the firm’s margin and return will look like over a several year span based on variations in the cost of capital, working capital and investment requirements per sales dollar, and environmental pressures on industry margins, as well as the riskiness of the investment before placing it in the model.

Distinctively different strategic objectives exist for each quadrant. The company can ask each functional area of the business such as marketing, personnel and manufacturing to identify specific strategies that would achieve the strategic objectives. In this paper the discussion is generally limited to marketing strategies and. therefore, strategic decisions related to the four Ps of the marketing mix (product, price, place and promotion).3 only in quadrant four where a functional orientation is inappropriate are nonmarketing strategies discussed.

In most cases a firm should seek the objectives and follow the strategies for the quadrant in which it is currently placed. However, where a firm is in danger of moving into a less desirable quadrant in the model (that is. it is near the boundary of two or more quadrants). a preemptive strategy may be most appropriate to follow. Each quadrant of the model will now be examined in terms of the relevant managerial objectives and their corresponding strategies.

Satisfactory Margin and Return Situation

The situation described above is, of course, the ideal one for a company; it is above the targeted threshold level in its short-term operations efficiency as well as in its long-term strategic goals. Unfortunately, too many companies tend to become myopic over time if they remain in this ideal situation. While the company enjoys the benefits of good performance with respect to operations and strategy, it should also plan to ensure its continued viability. This can be achieved by setting and attempting to reach two objectives.

The Market Entrenchment Objective.

The immediate strategic objective should be market entrenchment where the firm attempts to maintain and solidify its current position in the marketplace. When a company has achieved a satisfactory margin and return on its investment, there is a very strong likelihood that this success will invite relatively high competitive pressure. Competition may come from a variety of sources including new entrants, substitute products, forward integration by suppliers of raw materials and component parts as well as from large buyers who are tempted o engage in backward integration (Porter 1980). It is, therefore, vital for the company to set the market entrenchment objective with which to minimize competitive vulnerability from any of these sources.

There are two specific marketing strategies that can be used to achieve the market entrenchment objective. The first is a share protection strategy. Defending the company’s market share can be achieved based on overall cost leadership and/or differentiation while focusing efforts on its major customers. For example, brands like Mennon (aftershave). Bic (ball-point pens) and Campbells (canned soups) have successfully defended their market share over time by engaging in overall cost leadership so that no company can offer the same product at a cheaper price without substantial financial loss. On the other hand, Monsanto has instituted a differentiation program for Lasso, its successful but mature herbicide, to protect its market share. This is reflected in its product positioning with large farmers through targeted advertising and rebates on purchases of 55 gallon drums of the herbicide. Similarly, Fieldcrest Mills, which manufactures bedspreads, sheets, blankets, rugs, and other fabric products, instituted an account management program with major department stores and mass merchandisers in which its sales people were trained to build personal working relationships with several members in each of its key accounts. Finally, IBM has always successfully minimized competitive inroads by creating industry specialization in its sales force and account management activities.

A second and slightly longer-term strategy to achieve market entrenchment is the repositioning strategy. In light of changing market needs and societal lifestyles, the firm attempts to enhance the position of its current product lines by changing and extending their image through mass advertising or personal selling. Some minor additions to the firm’s product lines can also occur. While its current customer base may be emphasized, a slight extension to other target markets is also possible. For example, as a consequence of declining birth rates, an increase in working spouses and emergence of single adult households, Campbells is repositioning its soups from use as a meal supplement to use as a meal substitute product. A similar repositioning is currently practiced by Kelloggs to broaden and increase the consumption of cereals among adults.

The Market Expansion Objective.

The market entrenchment objective to ward off potential completion is extremely useful in the short run if the share protection and repositioning strategies are effectively implemented. Unfortunately, competitive pressures tend to remain high due to the firm’s satisfactory margin and return performance. Ultimately, the company must think strategically to convert a competitive (zero sum) game into a coexistive (positive sum) game. This can be achieved by setting the managerial objective of market expansion. A company in this quadrant will have the money, resources and borrowing capacity to fund a relatively costly expansion program.

There are again two fundamental strategies associated with this objective. The first is to redefine the market boundaries from the domestic to worldwide markets, a multinational strategy. This may include both marketing and manufacturing operations. For example, Coca-Cola has remained a profitable company by deciding several decades ago to bottle and distribute locally its soft drinks on a worldwide basis. In general, if a company belongs to an industry that is anchored to universal needs and wants, it is relatively easy to implement the multinational strategy. Examples include pharmaceuticals, heavy engineering and electronics.

The market expansion objective can also be achieved by expansion of the firm’s product lines. This is referred to as a full line strategy. As the name implies, this strategy expands the range of products and services offered by the company. In high technology industries, it is usually associated with product line stretching. In the process the firm should seek out and serve each desirable target segment in the industry through a differentiated marketing approach (Kotler 1980). For example, after its successful entry into the medium sized, digital PBX market, Rolm Corporation has stretched its product line over a much larger continuum based on the number of telephone lines its digital switch can integrate and manage. It now offers a full line of PBX equipment appropriate for a wider range of businesses from small to large. A more recent illustration of line stretching strategy is LBM’s manufacturing and marketing of personal computers.

A second mechanism of the full line strategy is to offer product assortments. Different products and services capable of satisfying different market needs are offered to the same target segment. The classic example, of course, was the emergence of Sears as the one-stop shopping place for practically everything that middle America needed and wanted.

The market expansion objective is clearly more risky than the market entrenchment objective because it requires significant changes in manufacturing, distribution and marketing operations in addition to greater capitalization of resources and manpower commitments. If a company is not careful in its expansion efforts, it can easily overextend itself and, as a result, move from the ideal quadrant to another less desirable quadrant in the model. For example, the failure of W. T. Grant Company is often attributed to a very rapid expansion policy. Numerous fast food chains have gone bankrupt in trying to expand their market coverage. We are also witnessing similar problems with many commercial airlines including the recent failures of Braniff and Laker. As inferred previously, market entrenchment should be effectively accomplished before an attempt at market expansion is undertaken; the short run objective must be achieved (or at least sought) before seeking the long run objective.

Since market expansion is directly tied to longer term capitalization of assets, a major factor in its critical success rests on long-term interest rates and the country’s monetary policies. If the interest rates tend to fluctuate wildly and are often unpredictable, it is even more risky for a company to engage in the market expansion objective.

Satisfactory Margin but Unsatisfactory Return, Situation

A company in quadrant two has a satisfactory net profit margin. However, due to heavy capitalization relative to sales volume, it is still below the targeted level of return on investment. In general, this situation is most common among companies in the early stages of their life cycles or companies that have undertaken major expansion programs.

The Volume Improvement Objective.

The short run objective for a company in this quadrant is to increase asset turnover through volume improvement, since each incremental dollar of sales revenue will contribute toward reaching the targeted return objective. There are two basic marketing strategies available to the firm to achieve its volume improvement objective. The first is sales stimulation through aggressive selling and promotion to both intermediaries and end users. On one hand, it can utilize the push strategy with resellers of its products and services through sales contests and other sales incentive plans. On the other hand, it can also utilize the pull strategy by strong advertising and sales promotions addressed to the end users. A good example of the sales stimulation strategy is the Bell System’s recent successful campaign for its profitable long distance service, using the slogan. Reach out and touch someone. Similarly, McDonalds has attempted to increase sales volume in its fast food franchised outlets through use of a sweepstakes sales promotion.

Another marketing strategy to improve volume is system selling in which the company sells a group of related and complementary products to the same customer. In this context, system selling does not necessarily involve new product development or additions to the product line; the firm attempts to sell existing products as a group. Systems selling has become common in the office equipment business among suppliers such as Xerox. AT&T and others.

System selling, however, is not limited to industrial products. For example, Cole National Corporation’s consumer products division consists of four major product lines: brass keys, colored keys, knives, and plastic letters, numbers and signs. In 1974 only four percent of its retail customers carded all four lines. To improve its asset turnover Cole instituted a systems selling approach that encouraged salespeople to engage in cross-selling. Each product line was related to the others in terms of special displays and relatively high margins for the retailer.

Two cautions are in order here. First, firms need assets to generate sales and if sales are increased, assets must also be expanded (e.g., raw material, work in process, finished goods inventories, delivery vehicles). Increases in sales beyond a safe range can actually hamper the firm in its drive to increase its return if increases in required assets are higher than the corresponding increase in sales. Second. the attempt to increase sales can result in a serious decrease in the firm’s net profit margin if taken too far. Promotion expenses and any discounting in price must be carefully controlled so that the margin will not decrease below its targeted level.

The Capital Restructuring Objective.

Unfortunately, there are situations where the volume improvement objective simply does not work due to temporary economic conditions. For example, the recent efforts by American automobile companies to stimulate sales through rebates and lower interest rates have been unsuccessful mostly because of high unemployment, high interest rates and a deep recession, It is also possible that the industry may be at a mature stage in its life cycle so stimulating sales may be more difficult. This is generally true of the appliance industry because it consists mostly of the replacement market.

In this situation a company can hope to improve its return on investment by instituting a capital restructuring program, definitely a longer run approach. Capital restructuring entails abolition of some of the firm’s fixed, relatively noncontrollable costs of doing business. En the marketing area this objective can be carried out by focusing on the company’s physical distribution, channel relationships and value-added services.

First, a company can attempt to restructure its capital through promoting distribution efficiency, a distribution productivity strategy. Here the emphasis is on decreasing the firm’s level of current assets by effectively managing inventory and accounts receivable. Adopting improved inventory control procedures while coordinating the ordering process and order cycle with associated firms would decrease resources tied up in inventory. For example, Japanese automobile manufacturers are achieving significant savings in inventory costs by utilizing the “kanban” or “just in time” system of assembling the automobiles and shipping them to the marketplace (a policy since joined by domestic manufacturers). Some American companies in agribusiness such as Archer-Daniel Midland are reducing inventory as well as transportation costs through development of computerized software programs for shipment of grains through trucks, railroads and barges. Eli Lillys physical distribution group recently instituted a material requirements planning inventory control system to lessen inventory levels within its distribution channel and, therefore, improve the firm’s return.

A second way to achieve capital restructuring is the reseller alignment strategy, where the firm centers its efforts on decreasing levels of its fixed assets in the distribution channel. If the firm currently has a company owned physical distribution system, some trucks and warehouses could be sold while using independent distributors, trucking firms and some public warehousing. By streamlining its sales organization through the use of manufacturers’ representatives and agents, or by instituting telemarketing programs (computerized telephone selling to dedicated accounts), a company can significantly reduce its fixed selling costs. Similarly, if a company has a corporate vertical selling system, it can convert it to a franchised selling system so that its capitalization in retail locations can be restructured. For example, IBM has given up its traditional vertical integration and district selling policy to end-users by adopting third party selling agreements with dealers such as Sears and Computerland fix its personal computer line. To avoid a large amount of capital invested in distributing its products. Heinz uses food brokers to contact wholesaling establishments.

In some cases it is also possible to consolidate distribution and selling functions by joint agreements between two or more companies. For example, at one time Whirlpool Corporation and RCA had a joint selling and distribution program to minimize capitalization in the distribution and selling areas. Similarly, Pillsbury currently utilizes Kraft Foods’ sales force and refrigerated trucks for its dough line instead of buying and maintaining its own fleet of trucks.

Finally, in the past companies have tended to provide a number of support services to the marketplace free of cost to the customer. This may include free delivery and installation, scheduled maintenance, liberal return or exchange policies, and credit float through its own credit cards. More and more firms are realizing that the hidden, uncontrollable costs of these support services are often staggering. For example, the Bell System discovered that the cost of installing the phone in the homes was prohibitive and it could not afford to continue to charge nominal fees as part of this support service. It has now instituted a program of designing modular jacks so that consumers can pick up and plug in their own telephones.

Capital restructuring is decidedly a much riskier corporate objective than volume improvement. First, it requires some reorganization and, therefore, there is generally strong resistance from all parties impacted by the decision. Second, the impact of strategies implemented to achieve capital restructuring is long-term; top management must have patience and confidence to sustain implementation. The temptation is often high to back away from continued support and sustenance of capital restructuring programs in the face of mounting opposition from all types of stakeholders and watchdogs. Third, capital restructuring strategies are inherently more risky since they require greater long-term capital commitments. For example, the jury is still out on whether Levi-Strauss Company will be able to survive and grow from its decision to align with convenience stores such as J.C. Penney and Sears. Much depends on the marketplace decision whether Levis is a specialty or convenience jean within the clothing business. Finally, fixed costs should not be reduced beyond a safe range as this will hamper the firm in having adequate capacity and customer coverage in a prosperous economy. In any case, an attempt at achieving the volume improvement objective should be made first.

Satisfactory Return but Unsatisfactory Margin Situation

In the third quadrant, a company is experiencing satisfactory return on investment but an unsatisfactory net profit margin. In general, this is true of mature industries and companies, partly due to depreciated book values of its capital assets, partly due to its lower interest rates on long-term debts secured under more favorable terms, and partly due to erosion of margins and a consequent profit squeeze created by intense price competition in the industry. A classic example of this is the present financial situation of the supermarket chains where net profits are generally less than two percent of sales, and yet most of them are still able to achieve a satisfactory return due to favorable most-gage rates and depreciated book values of buildings and fixtures. The company in this financial situation should set the following two objectives: margin improvement and product improvement.

The Margin Improvement Objective.

This short run objective refers to increasing the gross margins as well as net profit margins of products and services. One way to improve product margins is through a repricing strategy. The price charged by the firm may be too low on certain products relative to the firm’s cost of goods sold. Thus, tighter controls on pricing may be required along with a revision in pricing policy. Buyer selection and the evaluation of present customers become a relatively important consideration; current customers should be dropped if they are unwilling to buy the firm’s products at acceptable prices. For example, in an attempt to ensure adequate gross margins, a number of wholesalers in the medical supply and equipment channel do not allow their salespeople to deviate from list price unless they receive prior approval from upper management.

Repricing can also be achieved in other ways. For example, one can change the packaging size or shape and the form of the product to improve the margin. Currently this is very commonly utilized by the carbonated beverage industry. It tends to charge different prices for soft drinks in cans as opposed to disposable plastic bottles. A more interesting repricing mechanism is the switch from selling to leasing durable products such as automobiles. The dealer tends to improve his/her margin by performing scheduled maintenance, as well as by providing property and casualty insurance as pan of the lease price. With the significant increases in interest rates, many savings and loan institutions have developed “creative financing” programs such as variable term mortgages.

A second strategy to be used in reaching the margin improvement objective is the cost control strategy. This strategy increases the firm’s net profit margin by reducing variable and controllable costs associated with the manufacturing and marketing of products and services. The focus of this strategy is on the productivity of different functional areas of the business. Because increasing sales volume in itself is not a primary goal here, promotion costs may be kept at relatively low levels. By increased efficiency in the firm’s inventory control and logistics systems, ordering, warehouse, inventory carrying and delivery expenses can be decreased. Increases in fixed costs (e.g., purchase of computer control systems, newer delivery vehicles) can be incurred in the drive to decrease variable costs. For example, Stern and El-Ansary (1977) report that Marcor Corporation (formerly Montgomery Ward), in an attempt to improve its margins, achieved significant cost savings in its distribution center operations by utilizing computerization and automated handling equipment which reduced labor costs for order processing and filling. The W.H. Brady Company manufactures a broad line of products for industrial users that identify, inform, or instruct, such as nameplates, wire markers and safety signs. It is currently using a telemarketing program in low potential sales areas in an effort to lessen selling expenses.

The Product Improvement Objective.

A second longer-term strategic objective for an improved net profit margin is product improvement. Implementation of this objective involves alterations in the company’s product and market mix as well as its vertical relationships with suppliers, wholesalers and retailers.

First, a migration strategy should be considered. It emails assessment of margin contributions of each product or service, and adding or deleting products and services to improve the overall margin. For example, many supermarkets have added such product lines as L’eggs panty hose, delicatessens and even luncheon counters. In fact, major supermarket chains such as Jewel and Kroger are literally blurring the boundaries between grocery shopping and department store shopping by offering a wide assortment of nontraditional products such as housewares, cosmetics, clothing, cameras and electronic products.

In addition, the markets the firm is currently serving should be carefully evaluated. Customer selectivity should be the rule of the day so that unprofitable market segments are abandoned or given to competition by product pruning and selective selling approaches. Recently, many commercial banks have raised the minimum balances in interest bearing checking accounts to discourage very small depositors.

Similarly, some companies have learned to unbundle their offerings by eliminating many peripheral support services. For example, some supermarket chains have begun to offer highly selective products in “no frill” stores such as Aldi or Jewel. Similarly, some companies have eliminated low margin products or services. For example, several commercial airlines such as U.S. Air and Ozark Airlines have abolished first class sections in their planes. Libby. McNeill and Libby has recently sold some of its well-known canned fruit and vegetable lines because of low margins.

The migration strategy means many things, Depending on the industry. It is often referred to as the planned obsolescence strategy in durable goods businesses. For example, in the automobile industry it is used to pass on the incremental costs associated with engineering improvements and regulatory requirements. It is also referred to as the cannibalization strategy in nondurable goods such as soaps and detergents, cosmetics and personal care products. In general, the marketer is interested in retaining loyal customers while motivating them to buy a better product that also has a higher margin. Finally, the migration strategy is sometimes referred to as a “moving up the ladder” strategy. In many retail stores, a customer for replacement of durable goods such as automobile tires, furniture, residential homes and cars is “steered” by salespeople to buy higher priced items that have higher margins and commissions.

Another way to achieve the product improvement objective is trough a vertical integration strategy (forward or backward) that will provide economies of scale, increased control of sales and distribution activities, and overall cost efficiency in manufacturing and marketing operations. For example, many fast food franchising companies tend to engage in backward integration as a way to control costs of raw materials, supplies and cooking equipment. It is this vertical integration that gives McDonalds its greatest strength in French fries and hamburgers. Likewise, several packaged food companies have attempted forward integration by buying restaurants and fast food chains. Examples include Pillsbury’s successful acquisition and marketing of Burger King and Quaker Oats’ development of Magic Pan restaurants. Holiday Inn, in an attempt to ensure satisfactory margins, is evolving into a self-supply network that includes a carpet mill, a furniture manufacturing plant and numerous captive redistribution facilities.

Once again, it should be kept in mind that the product improvement objective is generally much more difficult and longer term as compared to the margin improvement objective. First, it requires significant changes in manufacturing and marketing operations. Second, it takes a considerably longer time period either to innovate new products or to integrate operations vertically. Finally, the strategies involved in product improvement often entail a considerable degree of capitalization. Therefore, any wrong decision may literally push the company into the fourth quadrant of an unsatisfactory margin and unsatisfactory return on investment. In that sense, the product improvement objective is similar to the market expansion and capital restructuring objectives of quadrants one and two respectively. The margin improvement objective must be sought before attempting to achieve the product improvement objective.

Unsatisfactory Margin and Return Situation

When a company finds itself in the fourth quadrant of the matrix, it has neither the margin nor capital leverage to fall back on. Under such financial conditions, more extreme measures are normally required. It is, therefore, not uncommon for a company in this situation to manifest crisis management. Furthermore, marketing as well as other business operations such as manufacturing or purchasing are relatively less useful in this situation. Instead, the company must focus on its management practices and procedures.

There are once again two strategic objectives a company can establish to survive and bounce back to a more desirable financial position. The first is corporate retrenchment and the second longer-term objective is corporate restructuring. Both are highly painful and unpleasant and require strong top management leadership. In fact, It is not unusual for many companies in this situation to hire a chief executive officer from outside the organization who can effectively act as a “hatchet man”.

The Corporate Retrenchment Objective.

This objective refers to organizational pruning and shaping so that the company becomes a more efficient, lean organization. One strategy for corporate retrenchment is overhead reduction. It requires systematic analysis of noncontrollable costs and finding ways to eliminate them. Reductions in staff personnel is the most obvious method of overhead reduction. Similarly, support systems such as consumer affairs and customer (raining may be eliminated or at least drastically reduced in funding. The overhead reduction process may entail closings number of branches or outlets that are highly unprofitable, as A&P is still continuing to do. It may also require closing certain manufacturing plants and consolidating operations into fewer factories, as Firestone has done. Finally, it may be manifested in tougher negotiations with labor unions and seeking major wage and benefit concessions, as has been done recently by the three major automobile manufacturers.

A second strategy to achieve corporate retrenchment is reorganization. In general, it entails a greater degree of centralization, increased span of control, reduction in the number of hierarchical levels, and institution of incentive compensation plans. The general emphasis in the reorganization strategy tends to be one of focus and specialization. This strategy may also cause divesting of manufacturing or marketing operations to concentrate on the strengths of the organization. For example, many American companies in the textile and consumer electronics industries have opted for outside sourcing, especially in Korea and Taiwan, and have instead concentrated on domestic marketing operations.

The Corporate Restructuring Objective.

This objective refers to restructuring the corporate mission and definition, entailing issues related to divestiture and diversification. Especially in cases where the corporate retrenchment objective is not effectively reached and a worsening financial picture exists, a divestment strategy needs to be considered. In cases where management feels a redefinition of the business can make the firm profitable but where the funds required for such a move are unavailable, a merger may be particularly appropriate. Selling the firm to another business organization represents another possibility, although the market and intrinsic value of a company with an unsatisfactory margin and return would be relatively low. If all else fails and financial conditions further deteriorate, the liquidation procedures of assignment or bankruptcy may be the only recourse. For example, a number of small breweries have been acquired by larger breweries in the face of increased competition and declining market shares. In the process, Heilemann has become the third largest brewery after Anheuser-Busch and Miller Brewing Company. Similarly, a number of famous retailers such as A&P and Korvettes have been sold to foreign concerns.

If a firm is careful and engages in strategic planning, it is possible for it to initiate a diversification strategy early enough to revitalize itself from impending financial disaster, especially if a high level of financial reserves still exist. Here, the firm can (I) acquire other business organizations or (2) reallocate resources from one group of products to another group that will facilitate movement to its desired position in the marketplace. For example, several years ago Gould Inc. decided to diversify its business from industrial batteries to industrial electronics by acquiring another company. On the other hand, Zenith Corporation has successfully reallocated resources to make a partial switch from consumer electronics to business microprocessors. Perhaps the best example of what looks like a very successful diversification program is the recent acquisition of Dean Witter (a financial brokerage firm) and Coldwell Bankers (a real estate firm) by Sears to position itself in the emerging financial services industry

Discussion and Implications

In our view, the margin-return model serves many useful functions in strategic market planning. First, it clearly subordinates all other functional goals and objectives such as market share, productivity and growth to the more fundamental and essential corporate financial goals. Since companies must be financially viable to survive and grow, this model reflects the concerns and philosophies of top management.

Second, the model enables the management to rank its strategic objectives and consequent marketing strategies based oat the company’s financial performance. For example, the model clearly discourages a company with poor reserves from engaging in market expansion programs.

Thud, the model recommends short-term and long- term objectives and strategies for each financial situation with a clear emphasis that the short-term objectives should be sought first. For example, attempts to achieve market entrenchment within quadrant one should be made before seeking the market expansion objective.

Fourth, it stresses the appropriate role of marketing strategies for the business organization. Marketing is but one resource and function of the firm: therefore, marketing strategies should be examined only within the context of corporate financial goals and processes designed to achieve them. Unless specific marketing strategies are directly linked to the financial goals of the firm, it is likely that their relevance and importance can go unappreciated in the organization. Furthermore, without this direct link, specific marketing strategies may result in a suboptimization of corporate goals and objectives.

Fifth, the model strongly suggests that the role of strategic marketing is far more critical in the off-diagonal quadrants, where there is at least one form of financial leverage available to the company. By the same token, strategic marketing is less relevant when the company is in a poor financial condition and has to embark on a major corporate retrenchment and restructuring program.

Sixth, it is interesting to note that the traditional elements of the marketing mix (promotion-selling and distribution) are most appropriate when the company has a satisfactory margin but unsatisfactory return on investment. On the other hand, the other two elements of the marketing mix (product and price) are more appropriate when the farm is experiencing a satisfactory return but an unsatisfactory margin. Similarly, the role of selling and distribution (push-pull strategies) seems extremely critical at the early stages of the corporate life cycle. However, at the maturity stage, it is important to shift focus onto product-price elements of marketing. These are traditionally controlled by the manufacturing and accounting functions in a company.

Seventh, the model can be used for a competitive analysis. After placing each competitor in one of the four quadrants, a firm’s management can forecast the competitive strategies they are likely to follow in the future.

Finally, the model is applicable to a portfolio analysis of a large, highly diversified, multi-business corporation such as Beatrice Foods.4 Business units in quadrant one should have relatively high levels of excess funds and borrowing capacity and therefore would represent a major source of funds for units in the other quadrants. The model also provides clues as to what to do within each quadrant as well as how to allocate resources across the four quadrants. For example, it suggests how to plough back financial resources within the “star businesses with the use of the market entrenchment objective.

The margin-return model can be extended in at least three different ways. First, the same general approach can be applied to nonprofit organizations. The main difference would be that the net profit margin criterion would be replaced by a reserves criterion, the difference in revenues a nonprofit organization receives versus the revenues that are spent. For example, at Blue Cross-Blue Shield maintaining targeted reserves (premiums received minus claims plus management costs) is the most commonly sought goal.

Second, the model needs to be expanded to include strategies that can be implemented by other functional areas to achieve the same organizational objectives. Certain functions] areas would have relatively high prominence in certain quadrants. For example, marketing, finance and production are functions of dominant importance in quadrant two where revenues, turnover and leverage are important while, in quadrant three, marketing, purchasing and cost accounting are prominent where an increase in firm’s net profit margin is important. By extending the model to include strategy development in other functional areas, the interdependence among the various functional areas of the firm could be more clearly identified.

Finally, in some cases it may be desirable or necessarily to broaden the corporate perspectives beyond its financial performance, For example, employee satisfaction and social welfare may be added as additional corporate goals. Of course, this will complicate strategic analyses and planning. However, the analytic hierarchy approach recently developed by Saaty (1977) and Wind and Saaty (1980) can be particularly useful in evaluating such goals and deciding which strategies to implement when certain goals conflict.

We are hopeful that both practitioners and academic scholars will find the model sufficiently interesting to carry out experiments or field studies to test it empirically. No doubt additional refinement of the general model in terms of the recommended objectives and strategies within each quadrant would result from such efforts. Each objective and strategy must be developed in greater depth.

References

Abell. Derek and John Hammond (1979), Strategic Marketing Planning, Englewood Cliffs, Ni: Prentice-Hall. Inc.

Day, George (19’77), Diagnosing the Product Portfolio.

Journal of Marketing. 41 (April). 29-38.

Kotler, Philip (1980). Marketing Management, 4th ed., Englewood Cliffs, Ni: Prentice-Hall, Inc.

Montgomery, David and Charles Weinberg (1979), Towards Strategic Intelligence System, Journal of Marketing, 43 (FaIl), 41—52.

Porter, Michael (l980), Competitive Strategy, New York: The Free Press.

Rappaport, Alfred (1981). Selecting Strategies That Create Shareholder Value, Harvard Business Review. 81 (May-June), 139—149.

Saaty. Thomas (1977), A Scaling Method for Priorities in Hierarchical Structures, Journal of Mathematical Psychology, 15 (June). 234—81.

Stern. Iouis and Adel El-Ansary (1977), Marketing Channels, Englewood Cliffs. NJ: Prentice-Hail, Inc.

Wensley. Robin (1981), Strategic Marketing: Betas, Boxes. or Basks, Journal of Marketing. 45 (Summer), 173—82.

Weston, J. Fred and Eugene Brigham (1972). Managerial Finance, 4th ed., New York: Holt, Rinehart and Winston, Inc.

Wind, Yoram and Thomas Saaty (1980). Marketing Applications of the Analytic Hierarchy Process, Management Science. 26 (July), 641-58).

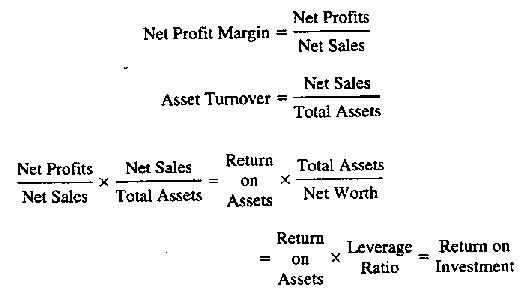

- An alternative calculation of ROI, which breaks out it’s components in greater detail, is given bellow-

↩

↩ - At first glance, one may expect net profit margin sad return to be highly correlated because the former is used in calculating the latter. However, In many cases they will not be highly correlated, if at all. The return measure also reflects assets management and financial management considerations. It will be heavily influenced by factors such as deputation schedules that do not influence the net profit margin. As stressed earlier, a firm’s return reflects the effectiveness (direction) of its overall strategic plan while its margin reflects its efficiency (operations) in carrying cut the plan. Most importantly the model in Table 1 is net based on absolute levels of margin and rerun but on how they compile to targeted levels. ↩

- Contrary to the modern definition of marketing, most companies still organize their operations separately for each element of the marketing mix. For example. the product variable is often associated with manufacturing and engineering. Price with the cost accounting function and place with the distribution function, with only promotion linked to the sales or marketing group. In that sense. our discussion is related to most operations within the firm ↩

- Care mutt be taken In making return on investment comparisons across divisions or business units within a corporation. Transfer pricing, varying depreciation schedule and industry conditions, the book value of assets, projects requiring heavy investments with long gestation periods in certain units. and a variety of other factors can mike one unit’, return look very different front the returns of other units in the corporation (Wetaco and Brigham 1972). ↩