Jagdish N Sheth (Emory University, USA) & Rahul Singh (Birla Institute of Management Technology, India)

Executive Summary

Indian business process outsourcing (BPO) industry, with a modest start in 1980s by British Air and American Express, introduced its presence in 1990s with opening of low cost service verticals with major launch of GE. The decade 2001 observed the growth, innovation and maturity in the industry and leadership of the Indian market. India leads the global market with almost 35 percent share and clear competitive advantage in knowledge based business. While it redefines BPO into business process management (BPM) and leads the BPO 4.0 metrics on foundations of value chain and disruptive innovations, it also potentially encounters the competition from newly established markets like Philippines, Vietnam, China, Mexico and few other countries. This paper presents a review of Indian past, present and way forward to future.

Introduction

Indian Business Process Outsourcing industry is usually registered in the domain of Information Technology Enabled Services sector (ITes). The Information Technology (IT) and the ITeS is sector is organised in four components: IT services, BPO, engineering services, R&D and software products. Over last 3 decades, Indian IT and ITES industry has achieved the strategic partner status globally. The Indian business process outsourcing industry is casted in the integral global sourcing strategy of the major multinational organisations and contributing significantly to the national economy. The percentage contribution of Indian IT/ITeS industry in GDP has risen from 1.2 percent in 1998 to an approximately 7.5 percent in 2011-12. The operations and size of the sector has motivated the singular association National Association of Software and Services Companies (NASSCOM) to review the domain and coined BPM (business process management) to replace BPO, arguing that it is not only the outsourcing but also that it has gone up in value chain and managing entire businesses processes of clients.

History of outsourcing business goes back to the initiative of British Airways in early 1980s with few other European Airlines and entry of American Express in late 1980s for back office operations. The organisations chose New Delhi / National Capital Region (NCR) as working entry location in the country. The major milestone was entry of GE as GE Capital International Services (GECIS) which recognised the business domain as an organised sector. Indian business operations of GE became huge in size in short time and it created a separate legal entity in 2004 as GENPACT.

Business Size and Value

In year 2011, the IT-BPO sector aggregated revenues of USD 90 billion and generated direct employment for over 2.5 million people and year 2012 is expected to cross USD 100 billion, and by 2015, it is expected to touch USD 130 billion. Everest Group and NASSCOM estimate that Indian BPO industry in size of USD 50 billion (NASSCOM, 2012). As per NASSCOM, Indian BPO industry is growing in its capacity and despite the rise of several alternative sourcing locations globally, it continues to maintain its leadership and accounts for over 37 percent of total global sourcing revenues and 58 percent market share in 2011 over 51 percent in 2009 (NASSCOM, 2008). On one side, while the industry moves on arbitrage over the labour cost for outsourcing decisions, the business is swelling due to enhanced activities in the outsourcing operations by business creators. On the other side, it also has margins hit due to foreign exchange volatility for business actors. The change in the market dynamics from off shore business to judicious mix of off shore and near shore business is offering an edge to locations of high capacity and mobility of manpower.

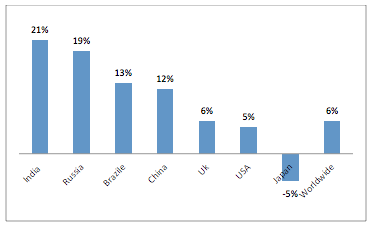

Figure 1: Growth of Selected Domestic Markets 2011

Source: NASSCOM Report, The IT-BPO Sector in India – Strategic Review

At broader scale, the IT-BPO market of India has shown an impressive growth of 20.70 percent over markets growth in Russia at 19 percent, China at 12 percent, and Brazil at 13 percent against global average at 6 percent. IT-BPO industry includes Hardware, Software Products, IT Services and BPO which indicates the horizontal and vertical strength available to ITes industry.

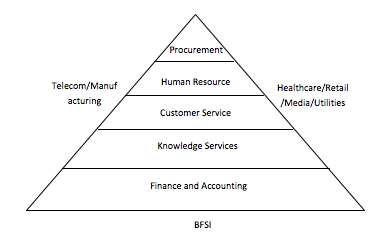

Figure 2: Service offering by Indian ITEs BPO companies

Source: NASSCOM Report, The IT-BPO Sector in India – Strategic Review 2011

The present scenario is in favour of India, but may not remain for long as immediate competitors like Canada and Ireland which is considered high cost manpower locations will become competitive on cost convergence theory. The technical expertise build by Indian companies like Wipro, Infosys, TCS, Genpact receive global delivery reputation, however a large number of small and medium firms in India serving application programming interface and software development, mobile and other telecom application development, web solutions and cloud computing services, gaming and consulting create a sound integrated capacity to service volume business.

Although, India is equipped with quality service delivery performance ranked as most preferred destination for companies exploring to offshore business of their operations in IT and back office function by AT Kearney’s ‘Global Services Location Index 2011’, other competitive locations like Malaysia, Indonesia, Philippines, Eastern Europe, Latin America, and China are also building their core competence. The sector, indeed, does not compete only on the operational efficiency and knowledge leadership but government regulations and compliances and financial leverages.

Market Dynamics

With more than one third of the global BPO market in India, it is creating business value from captive and third party service delivery to service optimisation, access to talent, productivity, and new business facilities for skill and knowledge cost arbitrage. The diversification in the sector has helped build its capacity to offer process based and knowledge based solutions to particular industries or verticals. The swelled figures over years indicate towards the developments in widened service portfolio and verticals, quality in delivery capabilities, capacity build on consolidation through mergers and acquisitions, innovative business and strategic execution models. The market composition no more counts only the international but also the domestic. Business opportunities are growing in established verticals like Banking, Insurance and Manufacturing, and also opening significant market space in niche verticals like technology, telecom, health, life sciences, travel and transport, education and publishing. It is estimated that the traditional verticals will constitute roughly 70 percent of the total export business of USD 220-250 billion by 2017. The knowledge based frameworks/service management are observed to be the next generation developments in the emerging markets like India which is afar traditional BPO and would demand a graduated skill set and knowledge domain.

On one hand, the domain is developing in both horizontal and vertical BPO service; the other hand, it is also being categorised in process, analytics, knowledge, and conception; and in geographic delivery models like off shore, near shore and on shore. India has developed capacity to cater to BPO solutions and it has developed a regional competition within country. A T Kearney published a survey on the regional competitiveness and describes Bangalore as “a gateway to new global frontiers”. The locations are categorized in 4 groups, viz. Leader, Challenger, Follower and Aspirants; New Delhi/ National Capital Region, Chennai, Pune, Mumbai, Kolkata, Bangalore, Hyderabad, are Leaders in BPO. Smaller cities like Kanpur, Lucknow, Indore, Jaipur, Ahmadabad, Bhubaneswar, Chandigarh are falling in the category of the challengers and Followers. And the newer concept, Rural BPO, is gaining the global attention since it helps in integrating the profit models with corporate social responsibility and inclusion i.e. economic upliftment of rural population.

Competitive Landscape and Leaders

At global level, India is still expected to lead the IT-BPO market by 51 percent market share with CAGR 15 percent, and almost 17 percent in only BPO in for 2007-12. NASSCOM estimate that BPO market should observe a CAGR of 13 per cent and to reach USD 225 billion by 2020 from USD 101 billion in 2012. As analysed by ‘KPMG & ASOCIO report on Asia–Oceania Vision 2020’, on one hand India would be edging over countries like Japan, Australia and New Zealand and getting competition from Sri Lanka, Pakistan & Bangladesh; it will still maintain its cost leadership on innovation and skilled labour, the latter being a critical issue in the present scenario. It is no surprise that the global financial crises in last few years will present a breakthrough change in the BPO market demand equation, its hygiene requirement, BPO delivery and process optimisation. The BPO sector raised approximately USD 15 billion from export of services in 2011 and accounted for leading destination for BPO service delivery, growing at almost 15 per cent CAGR.

The global sourcing to India is lead by US and has increased over years with minor variation. Almost 61 percent of the total export business is booked by USA followed by 21 and 10 percent by continental Europe and UK respectively. Understanding the global depression in different geographies, Indian companies have attempted mitigating their risk by geographic diversification and value creation through services and vertical optimisation which is principal reason of Indian market competitiveness in a period of economic gloom. Within the verticals, while Customer interaction services (CIS) remains the most important service line, knowledge service spread over verticals is catching up and major growth is observed from USA and UK. The growth has been supported by sizable production of qualified manpower coming from engineering, management, law and other technical fields; although it is not enough considering the demand curve estimated for future.

Despite the fact that Indian BPO industry has developed capacity in some of the verticals as discussed, it is required to develop competitive edge further in process and skill management. At domestic level, the roughly 12,000 service providers are collaborating and competing in the ecosystem and offering solutions and services to increasing international domain commerce and growing domestic small and medium business (SMB) business (Arouje, 2011). One of the major drivers to fabricate to higher degree capacity is coming from government demand from its national plans that has increased breadth of Indian companies offering in global market. The global and domestic market have attracted major companies like Apple, WNS, Infosys, TCS, Wipro and many small size firms in vertical integration. In the Indian market, Genpact, TCS BPO, Wipro BPO, Aegis BPO, WNS Global Services, Firstsource Solutions, IBM Daksh, Aditya Birla Minacs, Infosys BPO, Accenture India, HCL BPO would lead the market including few more and hold the major share of the business in domestic market as well from global pie.

The two important dynamics of the competition will remain differentiator. Rural BPOs of India initially will contribute to domestic market only but slowly build capacity for global market. In addition, India remains the biggest in youngest population in the world, produced almost 4.4 million employable graduates in year 2012 which remains the largest pool of talent globally. However, the specific demand of skilled manpower in I-BPO sector is required at improved quality.

Next Generation Growth

Transformation in the business models and practices in the generic domains like manufacturing, financial services, and technology i.e. low cost delivery are leading the demand for next level of BPO market. The new countenances like education, retail, health, and media sectors i.e. emerging growth drivers and new business models like cloud-based offering are promising contributors to the BPO domain. With more than 50 percent market in global business, India stands a good chance to maintain its position and increase competence in the existing and new BPO domains and compete with promising locations like China, Philippines, Mexico, Brazil, Vietnam, Poland, and Hungary. As second step in strategy matrix, India is broadening the business and diversifying the market to new and potential markets in Asia Pacific, the Middle East and.

The service lines, business verticals, and nature of work in BPO industry is enhancing and the new technologies are adding to the business mass. In the new decade, the industry is expected to build on its existing phase of evolution — BPO 3.0, which is characterised by greater breadth and depth of services; process re-engineering across the value chain; increased delivery of analytics and knowledge services across platforms and strong domestic market focus and SMB-centric delivery models 1. The accepted wisdom in business process outsourcing has evolved to business process management (BPM) and BPO 4.0 and it is characterised by the value chain and disruptive innovation in the industry to maintain the lead. Indian IT-BPO market is expected to swell to as high as USD 285 billion by 2020 as per the study of KPMG and ASOCIO (Asian-Oceanian Computing Industry Organisation)2.

Finally, the government’s support in setting up Information and Technology Parks, exemptions and rebates in taxation, establishing information Technology Investment Regions (ITIRs), and relaxed Visa norms are expected to be spring bound to an encouraging growth and matured ITes ecosystem in India to maintain leadership and innovate.

Further Reading

- Arouje Sanketh, India’s Top ITes & BPO Companies 2011, extracted on 20 October 2012, available from https://www.dnb.co.in/ITes_BPO_2011/Overview.asp

- India’s Domestic IT-BPO Market: Winds of Change, NASSCOM – Zinnov Report, 2011.

- Indian IT/ITeS Industry: Evolving Business Models for Sustained Growth, CII PWC Report, Pricewaterhouse Coopers, 2010.

- NASSCOM Report, The IT-BPO Sector in India – Strategic Review 2012, February 2012.

- NASSCOM Report, The IT-BPO Sector in India – Strategic Review 2012, February 2012.

- NASSCOM-EVEREST India BPO Study, Roadmap 2012 – Capitalizing on the Expanding BPO Landscape, January 2008.

- NASSOM Report, Indian BPO Industry: A Transforming Landscape, extracted on 30 October 2012, available from http://www.nasscom.org/indian-bpo-industry-transforming-landscape.