This paper suggests that the traditional theory of the firm assumption that competitive intensity is proportional to the number of competitors is not realistic. Instead, competitive structures are created by product and market differentiation. Four types of competitive structures are described, with examples: commodity markets, fragmented markets, differentiated markets and segmented markets.

Introduction

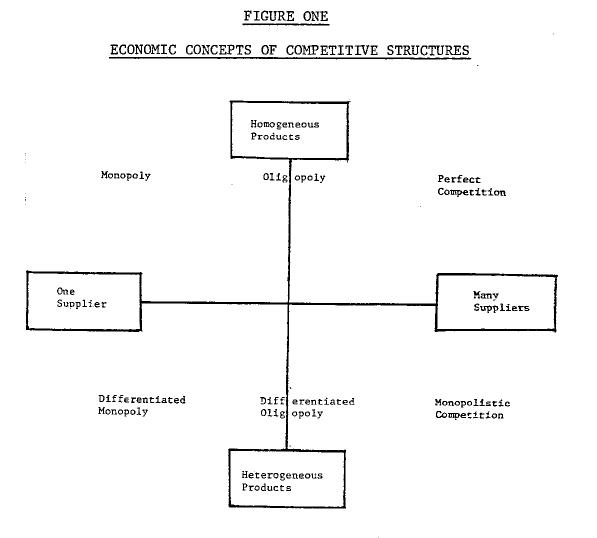

Theories of competition in microeconomics have been generally based on the realities of the times when they were developed. For example, in the preindustrialized age when the economy was dominated by the agricultural sector, theories of competition were based on the assumption of homogeneous products and therefore, competitive intensity was presumed to be strictly a function of number of suppliers in the marketplace. Indeed, most of the government antitrust policies and regulations related to the monopoly practices are still based on this assumption: competition is directly proportional to the number of competitors in the marketplace. The theory of the firm even provided us with such labels as monopoly (single supplier), oligopoly (concentrated few suppliers) and perfect competition (large number of small suppliers) to reflect this presumption.

With the emergence of the industrial age, it was discovered by several economists that competition and competitive structures are also a function of product or technological differentiation. For example, economists such as Chamberlain and Robinson suggested that product differentiations (real or psychological) created a certain degree of monopoly power for a supplier even when there were large numbers of suppliers in the industry. Since the traditional theories of competition could not explain this reality, it was necessary to broaden the determinants of competition to include both the number of suppliers and the degree of product differentiation. This led to a new form of competitive reality labeled as monopolistic competition.

Figure One represents this two—factor theory of competition.

This broadening of the determinants of competition has been extremely useful to account for a large number of market realities of the industrialized economy.

First, it enabled to explain the prevalence of supplier or brand loyalty based on such nonprice competitive factors as product differentiation, value—added services and even professional salesmanship.

Second, it clearly pointed out that not all monopolies are created equal and therefore, a monolithic regulatory process is inadequate. For example, it would be very difficult, if not impossible, to treat monopolies such as water and electricity which are based on homogeneity of products in the same category as monopolies of telecommunications and radio or cable communications which are clearly anchored to technology and value—add differentiations.

Third, it clearly demonstrated that the antitrust policies of the country needs to be amended or at least updated in light of a more complex set of determinants of competitive structures. In short, the present day antitrust laws may be Outdated and unrealistic.

New Determinants of competitive Structures

It is my contention that the revised theory of competition anchored to the two factors of product differentiation and number of suppliers is also becoming obsolete. It is being replaced by the new realities we are experiencing today as the economy shifts from the industrial to the post industrial age.

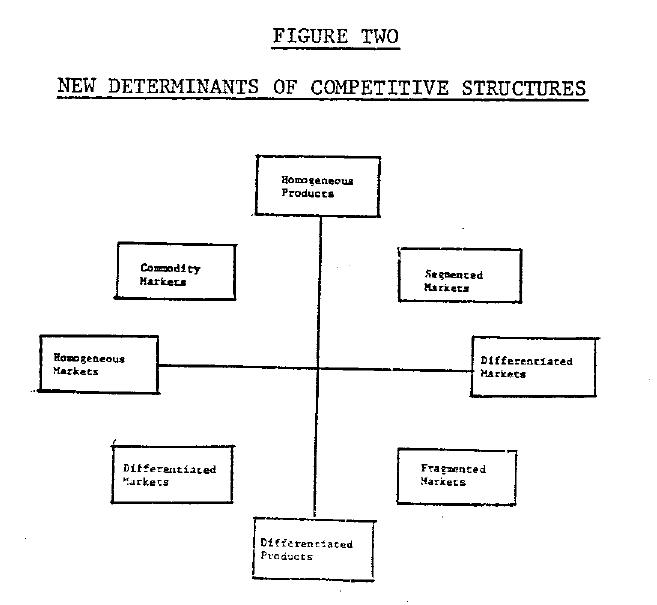

The new determinants of competitive structures seem to be anchored to the following two determinants: product differentiation and market differentiation. Furthermore, this is creating new and different types of competitive structures for which the traditional labels such as monopoly, oligopoly and monopolistic competition have no relevance. Therefore, we also need a new typology of competitive structures based on these new and emerging determinants of competitive structures.

Figure Two is an attempt to describe the new determinants and to generate a new typology of competitive structures. Each type of competition will be described and explained in more detail in the following pages. However, it is important to recognize that traditionally the most salient determinant of competition, namely number of suppliers, is conspicuously absent in the proposed typology. In other words, the new theory and its typology clearly reject the idea that monopoly is directly proportional to the number of suppliers in the marketplace. It is, therefore, possible to possess monopoly powers in an industry with a large number of suppliers and vice versa.

The four major competitive structures postulated in this paper are: commodity market, segmented market, differentiated market and fragmented market. Each will be described below and illustrated with industrial examples.

Commodity Markets

In an industry characterized by homogeneity of technologies and markets, the competitive structures most likely to emerge is commodity markets. Commodity markets refer to the reality of a handful of suppliers manufacturing a highly streamlined product offering and marketing them to customers on a non—differentiated basis.

The driving force in the commodity market is cost efficiency and economies of scale with respect to both manufacturing and marketing operations. It is possible that the scale economies may favor only a single supplier in the industry resulting in the traditional definition of a monopoly situation, However, there are no presumed entry or exit barriers, and therefore, it is possible for a more Cost efficient supplier to enter the market and successfully compete against the monopoly. For example, in many electromechanical industries such as tractors, earthmoving and earth digging equipment, the Japanese have successfully entered and taken the markets away from the American and European monopolies. On the other hand, it is possible for the monopolist to exit the market on a gradual basis, For example, several steel companies are presently exiting the markets due to the superior performance price ratios of substitute materials such as plastics.

Since cost efficiency and economies of scale are the driving forces in commodity competition, it is postulated that only three to four suppliers are likely to remain profitable. This is because it is likely to be uneconomical to divide the total industry capacity into smaller market shares.

The fundamental strategic issue in commodity competition is market share. Therefore, competitive strategies are likely to be designed and executed in order to protect or win a larger share of the market. These include acquisitions and mergers, price competition and share protection.

Commodity competition is becoming increasingly prevalent in many industrial markets including chemicals, semiconductors and basic metals such as steel and copper.

Differentiated Markets

Differentiated market is the most likely competitive structure in an industry where the market needs are homogeneous but there are alternate substitute technologies which can satisfy them.

Differentiated market refers to a reality in which a large number of suppliers provide specialized technologies and products to the marketplace with similar or even identical marketing programs. There are numerous industries characterized by differentiated market. For example, the telecommunication industry is manifesting alternate technological bases between digital vs. analog PBX and between digital vs. analog central office equipments. It is also demonstrating differentiated markets with respect to the cellular mobile vs. central office switching and cable vs. microwave local area networks.

Another example of differentiated market comes from the pharmaceutical industry in which each firm tends to have proprietary drugs which are offered to the same customers (hospitals and physicians) in the same manner.

The driving force in the differentiated market structure is strong R&D and highly proprietary products. Economies of scale and cost efficiency are less critical to competitive advantage. Therefore, the strategic issues are significantly different.

The basic strategies for success are R&D acquisition, R&D development and unique manufacturing expertise.

Segmented Markets

An industry characterized by a universal and versatile technology but catering to heterogeneous market needs is likely to manifest in segmented markets.

Segmented markets refer to a reality in which a handful of suppliers offer a common but versatile technology to differ market segments on an application based differentiation. In general, suppliers practice highly specialized or differentiated marketing program for each segment, although their R&D and manufacturing are more integrated.

The best industrial examples of segmented markets seem to be in the office automation industry. The universal but highly versatile technology of computerized data processing and data storage has enabled computer manufacturers to seek numerous applications specific to each segment. These include not only mainframe, minicomputers and microcomputer applications, but also manufacturing, payroll and telemarketing applications.

Another excellent example of segmented markets comes from the financial services including banking, brokerage and insurance. The applications of these universal but versatile services are quite different among business customers depending on their size and type of business.

The driving force in the segmented markets is application— based segmentation and customization. A supplier capable of offering unique marketing programs including industry specialized salesforce and customized products or services is likely to survive and grow in this competitive structure. While market share is an important objective, it is achieved less by cost efficiency and more by value—added services customized to each segment.

The strategic issues facing a segmented market structure are market segmentation, market expansion and total systems approach. There are several good examples of suppliers following this competitive strategy including IBM and AT&T.

Fragmented Markets

If a market is characterized by heterogeneous needs and heterogeneous means to satisfy those needs, the resulting structure is likely to be fragmented markets consisting of many specialists who cater to unique market segments.

Fragmented market reflects a reality of a large number of suppliers each controlling a smell market share but still retaining strong supplier or brand loyalty. Each supplier has some unique technological or value—added differentiation and markets his products selectively to a target segment with a highly customized marketing program.

It is more difficult to identify an industrial market with these characteristic. One good example comes from the large number of parts suppliers to automobile and appliance industries. Each parts supplier controls a very small share of the total market and at the same time, has a competitive advantage in terms of product or value—added differentiation. Another good industrial example comes from the custom shops for metal fabrication and metal mouldings.

The driving force of fragmented markets is niching or ultra—specialization. In fact, it is generally advantageous to aim for low market share rather than a higher market share. Both technological and application based ultra—specialization are necessary to survive and grow in fragmented markets.

The strategic forces in the fragmented markets are focus and expertise rather than market share and cost efficiency. Therefore, it becomes highly desirable to decentralize the organization which permits each unit to autonomously niche a fragmented part of the total market.

Summary

In this paper, I have identified two new determinants of competitive structures in industrial markets. They are product differentiation and market differentiation. I have also suggested that the traditional theory of the firm which is based on the concept of competition equals number of competitors is probably obsolete. Furthermore, we need to replace the traditional typologies such as monopoly, oligopoly and perfect competition with a new typology which reflects the new realities.

This paper has proposed the following four competitive structures: commodity markets, differentiated markets, segmented markets and fragmented markets. The driving force for a competitive advantage is likely to be different in each competitive structure. For example, cost efficiency and market share are the primary drivers in commodity markets whereas technical expertise and specialization are likely to be the primary drivers in differentiated markets.

The theoretical speculations proposed in this paper do have a strong face validity in terms of illustrating each typology with certain industrial markets. However, it will be desirable to carry out an empirical study of all industrial markets with respect to product and market differentiation.

References

Archibald, G.C. (ed.) (1971) The Theory of the Firm, Baltimore, MD: Penguin Books.

Chamberlain, Edward (1933) The Theory of Monopolistic Competition,Oxford, England; Oxford University Press.

Meade, J.G. (1937) Economic Analysis and Policy, Oxford, England; Oxford University Press.

Robinson, Joan (1933) The Economics of Imperfect Competition, New York, McMillan Publishing Co.

Porter, Michael E. (1980) Competitive Strategy, New York; Free Press.

____________ (1985) Competitive Advantage, New York, Free Press.

Stigler, George J. (1946) Theory of Price, New York, McMillan Publishing Co.