There is evidence that relationships are very important in effective marketing strategies. This article focuses on the relationship that firms need to develop with their suppliers. We propose that effective relationship with suppliers will provide firms with next-generational competitive advantage. Toward this purpose, the article discusses the reasons for the emergence of relationship marketing and the future academic research needed in this area. The article concludes that organizational buying is dramatically shifting from the transaction oriented to the relational oriented philosophy, and will shift from a buying process to a supplier relationship process. This shift toward supplier relationships will change the role, processes, and strategies of firms and, therefore, new areas of inquiry will emerge. These include understanding suppliers as customers; cross-functional supplier teaming; economic value of supplier equity; supply experience curves; hub and spoke organization; bonding with suppliers; global sourcing processes; cross-cultural values in purchasing; cross-national rules and regulations; and service procurement.

Introduction

With increasing turbulence in the marketplace, it is clear that firms have to move away from transaction oriented marketing strategies and move toward relationship oriented marketing strategies for enhanced performance [1]. General Motors, Xerox, Black & Decker, and Nieman Marcus, for example, are looking at relationships with their suppliers in order to achieve stronger competitive positions [2]. In concert with practice, the past decade has seen a fundamental change in the theory and practice of marketing [3]. The shift has been from research addressing transaction oriented marketing to research addressing relationship marketing. This is because of an increased recognition of the importance of satisfaction, retention strategies, and relationships to the performance of a firm [4].

We believe that the source of next-generational competitive advantage will be the type of relationships that firms have with their suppliers [5]. There are four reasons for this phenomena. First, marketers or sellers are driving this change as firms have started identifying and catering to the needs of specific customers. Thus, having a relationship with suppliers will enable firms to receive better service and therefore be more efficient in procurement. Second, firms will recognize that supplier relationships will allow them to be more effective. It is easier to implement strategies such as quality platforms, if firms have relationships with their suppliers. Third, there are enabling technologies that allow firms to select their best customers and suppliers. Computer programs allow firms to calculate profitability associated with each customer or supplier. Finally, competition and the growth of alliances will force firms to develop better supplier relationships to maintain a competitive edge.

The research in the past will become obsolete.

The purpose of this article is to assess the reasons for the rise in the practice of supplier relationships. We believe that a strategic focus of firms will be the development of relationships with firms’ suppliers. This focus will change organizational buying behaviors and create a need for understanding the process of developing relationships with suppliers. This article identifies new and exciting research opportunities and challenges in inter-organization buyer behavior due to the focus on supplier relationships.

Research in Organizational Buying Behavior

The earliest comprehensive models of buyer behavior were consumer behavior models. These major models were by Andreasen [6], Nicosia [7], and Howard and Sheth [8]. The earliest comprehensive models of organizational buying behavior had their origins in the consumer behavior literature and were developed by Webster and Wind [9], and Sheth [10]. Sheth, and Webster and Wind, studied the organizational buying process differently. Sheth [10] highlighted the effect of individuals in the buying process whereas Webster and Wind [9] emphasized the organization and its environment. After these comprehensive models, the research shifted toward attempts to model the buying process while studying specific problems in industrial and business marketing.

The industrial marketing discipline is increasingly influenced by the disciplines of organizational behavior, industrial organizations, and transaction cost theories in economics [11]. As an example, research on buyer-seller interaction and buyer-seller relationships, especially in the area of channels as customers, is heavily influenced by Stern and his colleagues [12] classic work on power, dependence, and conflict, and later by Williamson’s [ 13] transaction cost theory. Similarly, research and clinical case studies of supplier partnering relationships carried out by the IMP group in Scandinavia, and subsequent use of networks theory and methodology to quantitatively measure the strength of the customer-supplier relationships over time [14]. Also, research on quick response, just-in-time (JIT), and the use of electronic data interchange (EDI) for maximizing efficiency through economies of time (reduced cycle times) and mass customization is in sharp contrast to the older theories of economies of scale and scope [15].

While the last 25 years of research has continued the tradition of earlier research we see some challenges and opportunities in business-to-business marketing. We suggest that much of the research in the past will become obsolete as firms move away from transaction oriented policies to relationship oriented policies [5].

Customers realize that suppliers create value.

Shift in Organizational Buying Behavior

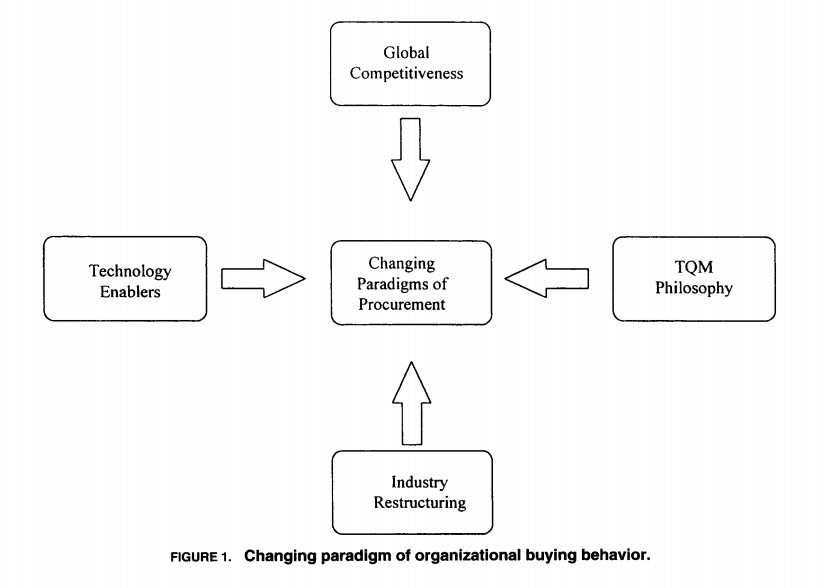

Organizational Buying Behavior has been dramatically changing since the 1970s for at least four reasons (see Figure 1). First, global competitiveness, especially in the manufacturing sector, such as process machinery, automobiles, and heavy engineering, have pointed out the competitive advantages of creating and managing supply chain relationships. Second, emergence of the total quality management (TQM) philosophy has encouraged “reverse marketing” starting with external customers and moving backward into procurement processes and practices, especially as they relate to reduced cycle times and zero inventory management. Also, the TQM philosophy highlights long-term perspective (e.g., relationships) rather than short-term perspective (e.g., transaction orientation). For example, demand driven manufacturing or flexible manufacturing and operations have been instituted to serve the diversity of demand with respect to form, place, and time value to customers over the long term. Third, industry restructuring through mergers, acquisitions, and alliances on a global basis has reorganized the procurement function from a decentralized administrative function to a centralized strategic function. This is further intensified by outsourcing (buy versus make) many support functions such as data processing and human resources. Finally, use of information technologies including networked computing, quick response, electronic data interchange, and other computer programmed procurement methods have restructured the buying philosophy, processes, and platforms.

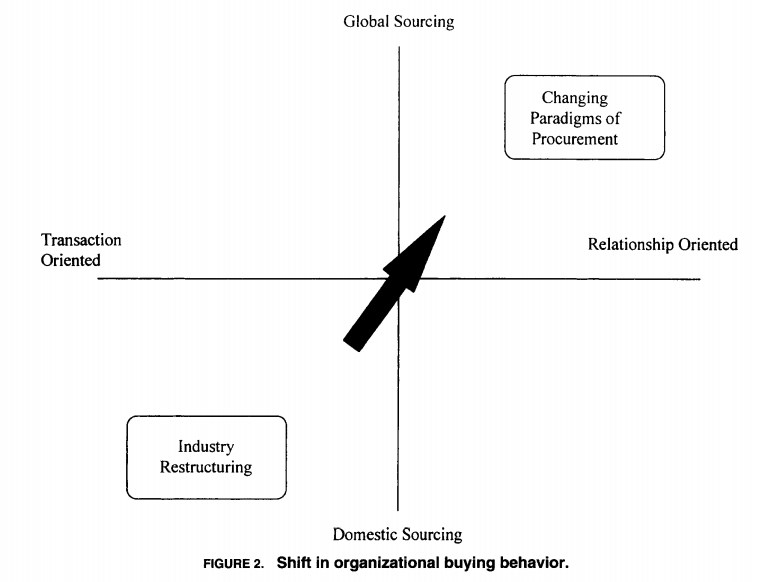

Fundamentally, the consequence of changing paradigms of organizational buying behavior is likely to result in a two-dimensional shift as shown in Figure 2. As organizational buying behavior shifts from a transaction oriented to a relational oriented philosophy, and as it shifts from a decentralized domestic sourcing to a centralized global sourcing process, most of the academic research and theory related to organizational decision making including the buying center concept, make versus buy decisions, sources of interdepartmental conflict and its resolution, and buyer-supplier negotiations will become obsolete. As Eric Hoffer [16], the philosopher historian has eloquently stated: “In times of drastic change, it is the learners who inherit the future. The learned find themselves equipped with a world that no longer exists.” We believe our older knowledge in organizational buying behavior is likely to be less and less valuable.

The primary reason is that customers realize that suppliers create value [15]. Thus, value creation by suppliers has become an area of interest to firms. Value creation can manifest itself into access to technology, access to markets, and access to information. Business customers will realize that suppliers provide access to value creation that will provide them with sustainable competitive advantage. We believe that relationships, specifically in the context of customers as well as suppliers, will emerge as an area of increased attention.

Research on Suppliers

Research has focussed on two issues regarding suppliers-supply chain management, and commitment and trust. Supply chain management and value creation aspects of supplier research are critical to our understanding of supplier behaviors. Research in supply chain management has modeled the supply process to reduce the inefficiencies associated with suppliers. The problem is more acute when a variety of manufacturing locations are supplied by both internal and external suppliers. Researchers have proposed models that allow manufacturers to examine the problems associated with suppliers [ 17, 18]. The applications of the new data interchange techniques should lead to better management of the suppliers.

Buyers have traditionally been quite willing to change suppliers.

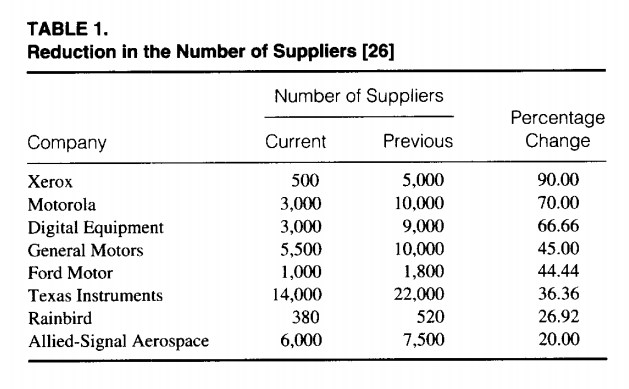

Commitment and trust on the part of the supplier have been acknowledged as being critical by buyers [2, 3]. However, the aspects of trust and commitment from the buyer’s perspective have not been examined except in the channel area. We suggest that it will not be easy for buyers to demonstrate commitment and trust as buyers have traditionally been quite willing to change suppliers. The reasons for customers often engaging in opportunistic behavior even though they are happy with existing suppliers by exercising their market power are simple. Business customers do not like to reduce the supplier choices because of the fear that they will be dependent on a smaller set of suppliers. This results in lack of a trusting relationship. Most suppliers, therefore, do not trust their customers. This trend has been changing. As an example, Xerox reduced the number of suppliers and found that they obtained better services and prices. This reduction in suppliers is widespread as can be seen in Table 1. The primary reason is the reduction in transaction costs associated with maintaining a large number of suppliers [13].

Relationship with Suppliers: The Next Frontier

As stated earlier, we suggest that developing relationship with suppliers will be critical for the functioning of firms. There are four underlying reasons for supplier relationships. These are increased cost efficiency, increased effectiveness, enabling technologies, and increased competitiveness.

Supplier relationships will reduce some of the costs associated with transactions. The transaction cost theory can be used to explain the increase in efficiencies associated with supplier relationships. Transaction cost theory suggests that properties of transactions (i.e., asset specificity, uncertainty, and infrequency) determine governance structure [13]. In situations of multiple suppliers, both buyers and suppliers feel a high level of uncertainty, and therefore there are multiple controls to ensure successful transaction. Controls increase cost and decrease the efficiency of relationships. In contrast, supplier relationships reduce uncertainty, and therefore controls, increasing the efficiency of transactions. An additional reason for supplier relationship will be the easy determination of customer profitability. Recent research has examined the costs of doing business with each individual customer [19, 20]. Because of better information technology, firms can track the actual cost of every transaction. Suppliers will be able to determine that it is not cost effective to provide their services to all of their customers. This will lead to a decrease in the number of customers for suppliers. Recall that relationships increase efficiency, and firms are less likely to be dropped if they have a relationship with the supplier.

Supplier relationships can also enhance the effectiveness of organizations. Firms may want the suppliers to invest in technology that will allow the firm to provide a quality platform, high level of customer service, availability of spare parts, and information exchange. Suppliers would be more willing to invest in assets if they feel that they have a relationship with the firm. As suggested earlier, a decrease in uncertainty (through supplier relationships) will encourage suppliers to invest more money into assets that will enhance the value provided by the buying firm.

Supplier relationships can also enhance the effectiveness of organizations.

Third, there are enabling technologies that allow firms to better connect with firms (e.g., JIT, EDI), and determine the outcome of relationships. Linkages such as EDI will reduce costs for both customers and suppliers and dramatically reduce cycle times. Also, with improved technology, firms can customize their offerings to individual customers. In fact, researchers suggest that there should be multi-tiered offerings for customers with customers self-selecting a level of service based on their purchase behavior [21]. This trend toward differential offerings is expected to increase because of three reasons. First, there are information systems available that allow marketers to determine the profitability of each customer of a firm. Second, information technology also allows marketers to cater to the need of individual customers (i.e., each customer can receive a customized offering). Finally, in an environment of ever increasing competition, firms would like to retain the more profitable customers at a cost of losing the less profitable customers. The consequence of better customer information and ability to customize offerings will lead to a higher level of customer selectivity. The consequence of customer selectivity will manifest itself into better customers getting better offerings than marginal customers. The trend toward determining and catering to the needs of profitable customers has major implications for marginal customers or customers that are average. If business marketers provide differential offerings to different customers, some businesses may have a resource based advantage over their competitors. Thus, it may be in a firm’s interest to be a better customer and receive additional services.

Finally, supplier relationships increase competitiveness by locking in good suppliers. Today, intense competition is coming from existing rivals, new entrants, and the threat of substitutes. Relationship with suppliers can be an effective method of reducing competition’s negative impact on an industry. This trend is reflected in Table 1, which suggests that some suppliers would be exclusive to firms.

Relationship with Suppliers as a Strategic Differentiator

As supply function becomes more a strategic differentiator and a core competency, it will encourage treating suppliers less as vendors and more like partners. In the future, we expect business customers will reduce the number of suppliers and invest in a handful of suppliers with respect to training, capital, and know how. In other words, firms will form relationships with suppliers and issues such as customer selectivity, key account management processes, and practices will become critical for managing relationships with their supplier community.

Therefore to maintain strategic advantage in the supply function, firms need to prove to the supplier the value of a relationship with them. Based on the research on alliances, some antecedents to successful supplier relationships are presented [22]. First, those relationships with suppliers will be sustained that are valuable to attaining a sustainable competitive advantage. Sustainable sources of competitive advantage are based on superior value, durability, competition not being aware of the source of advantage, and on being hard to duplicate [22]. Second, relationships with suppliers that are of mutual benefit will sustain. Third, relationships that are durable through mutual commitment such as common investments (i.e., exit barriers are high) will also persist. Fourth, organizations need to develop a culture where relationships with suppliers is valued. Finally, successful supplier relationships will provide firms with a first mover advantage, suppliers will come to the firm first to form relationships. Failures of alliances are due to a conflict in goals, lack of clear interaction partners, and shifting strategic requirements.

Avenues for Future Inquiry

As stated earlier, as we traverse from a transaction and domestic orientation to a relationship and global orientation, there will be an emphasis on developing relationships with suppliers. This emphasis of a relationship orientation toward suppliers will lead to an exploration of many aspects of business buying. These areas are highlighted in Figure 3.

Relationship orientation toward suppliers will lead to an exploration of many aspects of business buying.

Supplier as a Customer

As discussed earlier, there will be a thrust toward developing and maintaining relationships with customers. However, our understanding in this area is very limited. Some initial conceptual work in this area has been done by Wilson [15], which can be the basis of future investigations. He has identified areas of commitment, trust, cooperation, mutual goals, interdependence, performance satisfaction, structural bonds, adaptation, non-retrievable investments, shared technology, and social bonds as antecedents to successful relationships. In addition, some of the aspects of relationship that he identifies as needing further examinations concerning relationship success are breadth of purpose, boundary determination, value creation, and stability mechanisms.

Cross-Functional Supplier Teams

Marketers have used interdisciplinary teams to contact and maintain relationships with their customers. As individual suppliers’ relationships become more important we expect a similar thrust toward cross-functional teams that are dedicated or focused on their key suppliers. The importance of individual suppliers is expected to increase because of the emergence of sourcing on a global and relational basis with a few key suppliers. Researchers have examined and understood the interdisciplinary team process [23]. However, as these cross-functional supplier teams replace the buying center structure and process, there will be a need for applying existing knowledge, frameworks, concepts, and methods to enhance performance of cross-functional supplier teams. Some of the issues and problems with not having proper teams have been highlighted by Day [22]. In addition, Hutt [24] has identified factors that affect the performance of cross-functional teams. He identified the structural, social, and individual factors that affect cross-functional teams. Structural factors include attributes such as type of goals, reward structure, etc. Social factors include aspects such as group norms, social information, etc. Individual factors are self-monitoring, self-efficacy, etc. Clearly, this is a fertile area for future research.

Does Partnering Pay?

A major issue in relationship marketing is the return on investment in establishing relationships with customers. Similar concerns will also be expressed about partnering with suppliers. Therefore, there is a need to develop a performance metric that analytically quantifies supplier relationship equity. Our a priori hypothesis is that supplier partnering with smaller share suppliers will not be economical. The primary reason is that research has demonstrated that the cost of maintenance of smaller market share brand names is more that its value. The cost-benefit analysis of supplier relationships should result in increased supplier selectivity.

Companies will focus on creating core competency in supply side management.

Supply Experience Curves

Managing supplier relationships is not an easy task. The task of managing relationships on a global basis is more complex and not analogous to domestic supplier management as most business customers have realized. Therefore, in industries where supply function is a key strategic advantage, companies will focus on creating core competency in supply-side management and develop sharper experience curves. Therefore, we need to learn how to apply experience curve concepts and methods to supply-side management similar to what is applied in manufacturing.

Hub and Spokes Organization

We expect organizations to reduce the number of suppliers in each product or service category. In addition, reengineering has forced firms to outsource internal activities. We expect the results of the culmination of these two trends to be very interesting. There will be multiple suppliers, which will provide critical products and services to a central organization. This will lead to a hub and spoke organization in which one or two suppliers in each product or service category are the spokes and the procurement organization becomes the hub on a global basis. This hub and spokes organizational architecture has analog in local area networks (LANS) and in computer assisted logistics systems (CALS). It would be fascinating to use networks methodology to study the hub and spokes organizational designs.

Bonding with Suppliers

Marketers, specifically those that practice relationship marketing have learned to bond with their customers. Bonding relates to the empathy that the marketing organizations feel toward their customer groups. With an increasing trend toward creating, managing, and enhancing ongoing relationships with suppliers on a global basis, organizations will have to learn about and invest in bonding processes and philosophies. These policies will be similar to what organizations are learning and practicing with their customers. Some of the questions that will need to be answered are: what are the governance concepts and processes for bonding with suppliers? Similarly, are they different from the governance processes appropriate for bonding with customers? Among the first steps in the bonding process will be the introductions of technology such as EDI.

Global Sourcing

We expect global sourcing to be a strategic advantage. While several global enterprises, especially in the automotive, high technology, and aerospace industries are establishing processes and platforms, it is still at an infancy stage of practice in other industries. This area is expected to be a key driver for future academic research. An initial framework to examine global sourcing strategies has been provided by Kotabe [25]. Similarly, the area of logistics has been publishing research in this area. However, in the following years we expect an explosion in the research done in this area.

Cross-Culture Values

Both the buying and selling practices and value systems vary significantly across cultural boundaries. As an example, firms in the United States are concerned about short-term profitability whereas firms in Japan are concerned about long-term positioning. Similarly, in some cultures, reciprocity is declared illegal and unethical whereas in other cultures it is the preferred way of doing business. What is considered as an agency fee in one country is recognized as a bribe, subject to prosecution under the anti-corruption laws in another. Similarly, doing business with family members and politically connected individuals is presumed to provide a sense of trust and commitment in some cultures whereas it is considered as nepotism and unethical behavior in others. Although academic researchers have devoted considerable effort toward this area, our understanding is very limited. We regard this as another area of academic research of enormous potential.

Cross-National Rules

Similar to cross-cultural differences, there are also cross-national rules that regulate economic behaviors of enterprises. Specifically, the two-tier regulations (one for domestic and the other for foreign enterprises) are common with respect to ownership, management control, and coproduction practices. With the rise of nationalism in recent years, this has become a key issue for global enterprises such as McDonalds, Coca-Cola, General Electric, and Enron, especially as they expand their market scope and supply scope in large emerging nations such as India, China, and Indonesia. This is an area that we think has potential for research and understanding.

Services Procurement

Academic research in business buying has been dominated by product procurement; however, our academic knowledge for services procurement seems to be limited. As organizations outsource more and more internal services, and as suppliers engage in providing value added services to their customers, one expects greater need to understand and research services procurement. Additionally, as most advanced countries are services economies, services procurement will rise in prominence. Some of the issues that will need to be addressed are: Are services different than products? What is the impact of perishability, simultaneity of production and consumption, and lack of standardization on services procurement function, especially on a global basis? This understanding will be critical for advertising agencies, professional services (accounting, legal, human resources, and consulting), as well as information services (data processing, telecommunications, and on-line services).

Conclusions

This article examined the reasons for the emergence of new organizational buying paradigms and the future academic research needed in this area. The article concludes that organizational strategies will shift toward developing relationships with suppliers. This will change the role, processes, and strategies of firms that will lead to an emergence of new research. The research areas include understanding suppliers as customers; cross-functional supplier teams; ROI of supplier partnerships; supply experience curves; hub and spoke organization; bonding with suppliers; global sourcing processes; cross-cultural values in purchasing; cross-national rules and regulations; and services procurement.

References

- Noordewier, Thomas G., John, George, and Nevin, John R., Performance Outcomes of Purchasing Arrangements in Industrial Buyer-Vendor Relationship. Journal of Marketing 54, 80-94 (1990).

- Ganesan, Shankar, Determinants of Long-Term Orientation in BuyerSeller Relationship. Journal of Marketing 58, 1-19 (1994).

- Morgan, Robert M., and Hunt, Shelby D., The Commitment-Trust Theory of Relationship Marketing. Journal of Marketing 58, 20-38 (1994).

- Byrne, John A., Brandt, Richard, and Port, Otis, The Virtual Corporation. Business Week 3304 (February 8), 98-102 (1993).

- Sheth, Jagdish N., Strategic Purchasing: Sourcing for the Bottom Line. Conference Board Report Number 1157-96-CH, The Conference Board, New York, 1996.

- Andreasen, Alan R., Attitudes and Consumer Behavior: A Decision Model, in Research in Marketing, Preston E. Lee, ed., University of California, Berkeley, California, 1965.

- Nicosia, Francesco M., Consumer Decision Processes. Prentice Hall, Englewood Cliffs, New Jersey, 1966.

- Howard, John A., and Sheth, Jagdish N., The Theory of Buyer Behavior. John Wiley & Sons, New York, 1969.

- Webster, Fredrick E., and Wind, Yoram, A General Model for Understanding Organizational Buying Behavior. Journal of Marketing 36, 12- 19 (1972).

- Sheth, Jagdish N., A Model of Industrial Buyer Behavior. Journal of Marketing 37, 50-56 (1973).

- Sheth, Jagdish N., Gardner, David M., and Garrett, Dennis E., Marketing Theory: Evolution and Evaluation. Wiley, New York, 1988.

- Stern, Louis W., and Reeve, Torger, Distributional Channels as Political Economies: A Framework for Comparative Analysis..lournal of Marketing 47, 55~67 (1980).

- Williamson, Oliver, The Economic Institutions of Capitalism. Free Press, New York, 1985.

- Ford, David, Understanding Business Markets: Interactions, Relationships and Networks. Academic Press, London, 1990.

- Wilson, David T., An Integrated Model of Buyer Seller Relationships. Journal of the Academy of Marketing Science 23(4), 335-345 (1995).

- Hoffer, Eric,

- Davis, Tom, Effective Supply Chain Management. Sloan Management Review. 35-46 (1993).

- Cavinato, Joseph L., A Total Cost/Value Model For Supply Chain Competitiveness. Journal of Business Logistics 13(2), 285-301 (1992).

- Grant, Alan W.H., and Schlesinger, Leonard A., Realize Your Customers’ Full Profit Potential. Harvard Business Review 59-72 (1995).

- Shapiro, Benson P., Rangan, V. Kasturi, Moriarty, Rowland, and Ross, Elliot B., Manage Customers for Profits (not just sales). Harvard Business Review, 101-108 (1987).

- Berry, Leonard L., Relationship Marketing of Services–Growing Interest, Emerging Perspectives. Journal of the Academy of Marketing Science 23(4), 236-245 (1995).

- Day, George S., Advantageous Alliances. Journal of the Academy of Marketing Science 23(4), 297-300 (1995).

- Fennell, Mary L., and Sandefur, Gary D., Structural Clarity of Interdisciplinary Teams: A Research Note. Journal of Applied Behavioral Science 19(2), 193-202 (1983).

- Hutt, Michael D., Cross-Functional Working Relationships in Marketing. Journal of the Academy of Marketing Science 23(4), 351-357 (1995).

- Kotabe, Masaaki, Global Sourcing Strategy. Quorum, New York, 1992.

- Emshwiller, John R., Suppliers Struggle to Improve Quality as Big Firms Slash their Vendor Roles. Wall Street Journal, August 16, B 1, ( 1991 ).