Jagdish N. Sheth and Atul Parvatiyar, Emory University Atlanta, USA

The popularity of business alliances has increased in recent years. Business and academic press have reported thousands of alliances involving many international companies (ElIram. 1992: Ghemawat et. al. 1986 Gross and Neuman. 1989: Morris and Hergert 1987). Its importance is realized by the fact that some of the world’s largest companies, including AT&T, Philips, General Motors, Siemens, IBM, Ford, Boeing, Olivetti, General Electric, Xerox, Toyota, Mitsubishi, General Foods, and several others are involved in these business alliances. A variety of patterns are also observed such as large-small company alliances (Doz, 1988: Hull and Slowinski 1990), private (profit) — public (nonprofit) partnerships (Lynch. 1989), competitor alliances (Hamel et al. 1989), and spider-web alliances (Gullander 1975) wherein an intricate array of interconnections between companies, often across international and industrial boundaries, exist — as in the case of networks and Keiretsu [1] (Ferguson. 1990; Hákansson and Johanson. 1988).

The scope of these business alliances from specific functional agreements — as in R&D, product development, distribution, logistics, marketing, etc. to full scope joint venture and/or consortia. This had led to several names and labels for business alliances: for example, joint ventures, R&D consortia, minority participation, cross-licensing, cross-distribution, supply purchasing, franchising, co-manufacturing, buying groups, and so on. Some authors have begun to “-a strategic alliance” as a common term to refer to all types of business alliances (Harrigan, 1986: Ohmae, 1989; Parkhe, 1991). This however, is likely to cause confusion because, as we will show later in this article, not all business alliances are formed with a strategic purpose: furthermore, strategic alliance is a term borrowed from military and political science where it has a specific connotation, namely formal association of soveren states for the use (or non-use) of military force, intended against specific other sovereign states, whether or not these sovereign states are explicitly identified (Snyder. 1991). As such, the use of “strategic alliance” in business is best suited for competitive alliances and, in our opinion. it would not be used as a generic term for all alliances. In this article, we will develop a typology of business alliances in order to reduce some terminological confusion.

Given the current popularity of business alliances, a comprehensive theorv to explain the purpose. properties and governance of alliances is needed. Although research in this area has been sparse, previous studies in strategic management and international business have developed constructs on the rationale for co-operation (Contractor and Lorange. 1988). alliance complexity (Killing. 1988). factors governing degree of co-operation in 50:50 equity joint ventures (Buckley and Casson, 1988), alliance characteristics and International arrangements (Borys and Jemison. 1989), the influence of technological intens and R&D intent of partners on the choice of alliance governance form (Osborn Review and Baughn, 1990). and social governance of dyadic networks (Larson, 1992. While these conceptual frameworks and empirical observations have significantly contributed towards understanding some specific aspects of business alliances what is lacking is a general theory of business alliances accordingly this art is an attempt to develop a theory of competitive and collaborative business alliances. It is based on a fusion of behavioral and economic constructs that underlie and determine formation, governance properties and the evolution of business alliances.

The theory is based on two constructs: purpose of the business alliance (strategic versus operations) and parties to the business alliance (competitors versus non-competitors) that most forms of business alliances and their specific properties, governance structures, arid evolution over time, can be explained by these two constructs. Furthermore, we can provide a strong rationale for them based on several popular and powerful conceptual frameworks in organization, behavioral sciences, and social sciences.

Theoretical Background on External Relations of Firms

It is important at the outset to define business alliances. A business alliance is an ongoing, formal, business relationship between two or more independent organizations to achieve common goals. This definition encompasses any formalized organizational relationship between two or more firms for some agreed purpose. It refers to the external relationships of a firm with other firms where the relationship is more than a standard customer-supper or labor manager relationship, and more than venture capital investment or other stakeho. relationship, but falls short of an outright acquisition or merger. Evident in our definition, all business alliances have two underlying dimensions: purpose and parties. In this section. we will develop theoretical support for the two underlying dimensions of alliances and in the following sections examine the characteristics of different types of alliances and their effects on governance structures.

The study of a firm’s external relationships are grounded in four theories: transactions costs theory (Williamson, 1975. 1985), agency theory (Fama. 1980: Jensen and Meckling. 1976). relational contracting (Macneil, 1980). and resource-dependence perspective (Pfeffer and Salancik. 1978). While the common theoretical constructs in the first three approaches are the notion of contracts and transactions, the resource-dependence perspective is concerned with organizational interdependencies and inter-organizational power. An examination of the basic propositions of each theory will help identify the applicable constructs Irons these theories in understanding the nature and properties of alliances.

The primary concern of agency theory is the optimal incentive structure that will help avoid efficiency losses, given the conflicting interests of a principal and agent (Fama and Jensen, 1983). Since, the agency theory presupposes a conflict of interests among interacting parties, it does not provide the appropreate Business perspective for the of business alliances. In Other words conflict Alliance of interest is not the basis for business alliances, but a potential context which Formation may or may not exist in a specific business alliance.

The resource-dependence perspective is anchored on two themes: that organizations are the primary social actors and the interorganization relations can be understood as a product of interorganizational dependence and constraint (Pfeffer. 1987). This perspective sees the question of who controls the organization as both problematic and critical (Mintzberg. 1983). The issue of control is linked to apprehensions regarding intent (trust) of each party. In essence, the issue of intent or trust can be considered as the underlying dimension of such apprehensions. If the organizations were certain about other actor’s actions and intentions and, consequently. trusted each other, the concern for control or internalization of interdependencies would be minimal. Thus, trust is the underlying determinant of managerial action relating to control and acquisition of power. The more the actors trust each other, the less will be intentional managerial action towards control of external interdependencies.

This notion of trust, as in important dimension of a firms external relationship is also supported in Macneil’s (1980) relational contracting. There is a tacit assumption of trust of relationship contracting unlike discrete contracts wherein there in no room for tacit assumptions (Macnell. 1980). Other studies on alliances have also included trust as a significant variable in analysis of partner relationship (Buckley and Casson. 1988: bison. 1992; Schaan and Bearmish. 1988).

While recognizing the value of trust, transaction costs theorists have contended the difficulties of operationalizing trust and hence avoided it (Williamson. 1975. 1984.1985). The basic proposition of transaction cost theory is that properties of transactions determine the governance structure and the institutional arrangements of firms (Reve. 1990: Williamson. 1985). Transaction costs economics provisionally identifies three key dimensions on which the properties of transaction differ: asset specificity (or the degree to which assets are dedicated to transacting with a particular economic partner): uncertainty (that is. ambiguity in transaction definition and performance); and infrequency (transactions that are rarely undertaken). Of the three, asset specificity is considered the most important and most distinctive (Williamson. 1990).

In our opinion asset specificity and infrequency which transaction costs theory treat as determinants, are really the consequences of managerial choice of a specific institutional arrangement or alliance form, and therefore they are consequent and not determinant variable. For example the choice of joint venture or consortia as an institutional arrangement warrants commitment of specific assets to the project whereas, such degree of asset specificity may not be required in case of co-operative agreements or cartel type alliances. In fact, studies on joint ventures21 (Harrigan. 1985: Killing. 1983; Stuckey. 1983) have not indicated that joint ventures are not an inherent outcome in those cases where organizations have already committed specific assets to a project. In short asset specificity seems more an outcome, or a consequence rather than the cause of business alliances. Given the fact that asset specificity can be a consequence of business alliances, we have decided not to use it as of the determinants of business alliances.

Similarly frequency of transactions is a managerially controlled decision which is influenced by the choice of particular institutional arrangements. For example, firms may choose to reduce or expand frequency of transactions based on technical, physical, managerial and considerations. One has to just look at the impact of online computerized systems In changing the frequency between alliance partners (say between buyers and sellers). As we will shoe in subsequent sections, frequency of transaction is more a consequence of purpose and parties to business alliances. For example operational purposes necessitate greater frequency than strategic purposes.

Perhaps, the most significant dimension of transaction costs theory which influences the selection of the type of institutional arrangement is uncertainty. It plays a role in the supply of upstream product)service and the need for information by the downstream firm (Arrow. 1974). Uncertainty is the consequences of environment and largely has external origins due to random acts of nature and unpredictable changes in customer preferences (Koopmans. 1957). Uncertainty, unlike asset specificity and infrequency, is not managerial controlled. On the other hand, organizations and managers have to cope and deal with uncertainty it is therefore, an independent variables that determines managerial action. Based on the level of uncertainty that has to be coped with managers will choose an institutional form that helps reduce those uncertainties.

Hence, we can infer from theories on external relationship of firms that there are two primary constructs the affect alliance relationships and its institutional arrangement: uncertainty and trust. The level of uncertainty and the level of trust are likely to impact on alliance characteristics. When there is high between partners, autonomy will be accorded to the venture. Low amongst partners is likely to lead to high management control. it will also result in greater degree of internalization of interdependence and use of power as suggested by resource dependency viewpoint. Similarly, when uncertainty is high, management will like to make assets specific to the transaction so that risk is delineated to the transaction specific assets and partners are also locked in through designated commitment. In case of low uncertainty, partners will be willingly to rely on market processes of buyers and sellers or in sharing of assets of the two firms.

Measurement of Uncertainty and Trust

Uncertainty and mist are not variables but constructs. Therefore, they need to be operationalized in order to link with reality and empirical observation. Trust is a behavioral construct and, therefore. it is often measured by self assessment and perceptions of individual managers and decision makers involved in business alliances. Unfortunately, we have not yet fully developed a psychometric scale that measures trust with a degree of reliability and validity sufficent to feel comfortable (Andaleeb, 1992). Similarly, measures of uncertainty suffer from problems of ambiguity with respect to definition and observation.

In view of the fact that the traditional measures of trust and uncertainty are Business subject to measurement errors, we have adopted the econometric approach Alliance of identifying measurable indicators that can be good surrogates of each Formation construct. By measuring the purpose of a business alliance as operations versus strategic, we are able to capture the degree of uncertainty. Operations purposes are, by definition, more certain than strategic purposes because the latter are. by definition, anchored to the future.

Trust is a perceived notion regarding a partner’s likely behavior. It is perceived estimation of behavioral “opportunism” (Williamson. 1975) of the alliance partner. Such perception of opportunistic behavior is likely to be associated more than partners who are competitors or are perceived as potential competitors. Guarding against competitors in an alliance relationship has thus been the concern of some studies (Hamel et al.. 1989). It can therefore, state that trust is manifested in parties to an alliance, where the competitors are viewed with low trust and non-competitors are generally viewed with greater trust.

Purpose and parties are, therefore, isomorphic dimensions of uncertainty and trust. Purpose and parties are easy to measure and hence, we will use them. In the previous section we had defined business alliance with the two underlying dimensions of purpose and panes. Thus can be expressed rotationally as:

Business alliance — f (purpose, parties)

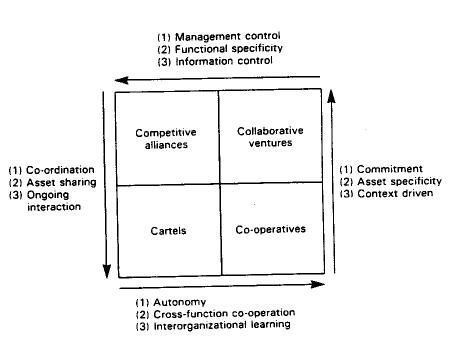

The two dimensions can be easily dichotomized for a conceptual understanding of alliance types, its properties and governance structures. It is also possible to represent the dimensions in the form of vectors representing the degree of strategic purpose and the degree of competitive rivalry among alliance partners. The dichotomous categorization of purpose and parties helps us here in highlighting the distinctive properties of each type of alliance and making observations on the distinctive forms of governance structures associated with each type of alliance.

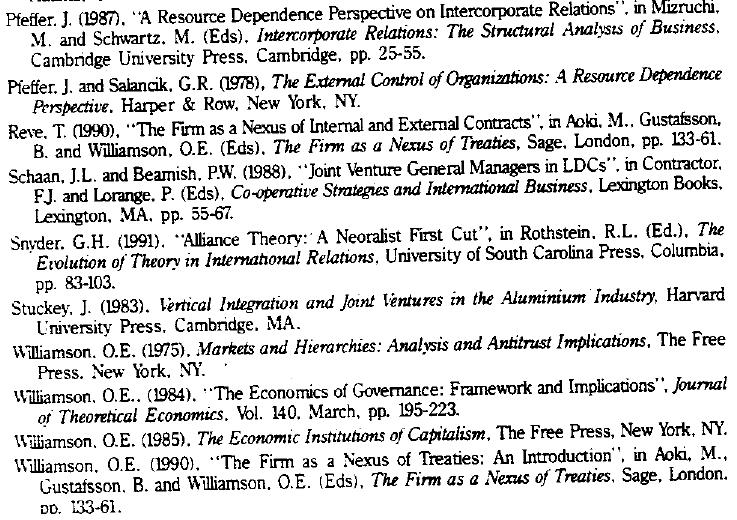

Table 1 provides a typology of business alliances based on the two dichotomies of purpose and party. If a business alliance is formed fur operations efficiency among competitors. it is called a cartel. If it is among non-competitors (suppliers, Customers, and non-competitive businesses) it is called a co-operative. If a business alliance is formed for strategic purpose among competitors. it is called a Competitive alliance. Finally a business alliance among non-competitors for strategic purpose is called a collaborative venture.

Purpose of and Parties to Business Alliances

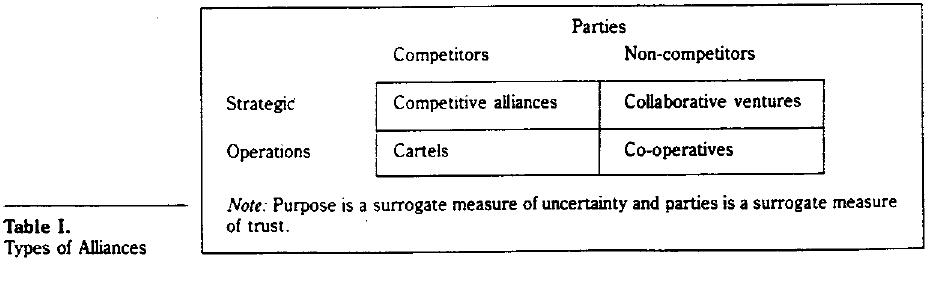

Several factors drive companies towards entente. Some are related to microenvironment forces like globalization and integration of markets, rapid Changes in technologies high cost of R&D. increased global competition and Shortening of the period of competitive advantage (Badaracco, 1991; Collins and Doorley, 1991; Ohmae. 1989). Others are linked to corporate objectives and The basic question of why companies form alliances can be answered by focusing on the corporate purpose these alliances fulfill. As shown in Figure 1. Eight corporate alliances purposes can be broadly identified. Four of these growth opportunity, diversification, strategic intent and protection against external threat[3] — reflect the future reasons of forming alliances. They are considered strategic because they impact on corporate effectiveness, that is, its future position and competitiveness. The other four alliance purposes — asset utilization resource efficiency, enhancing core competence and bridging the performance gap — represent the operational purposes of alliance. They are operational because they impact upon corporate efficiency and improve the current position of the firm[4].

The strategic and operations purposes of alliance may overlap. However, based on the primary purpose, we can safely dichotomize the alliance purpose as predominantly strategic or predominantly operations in nature.

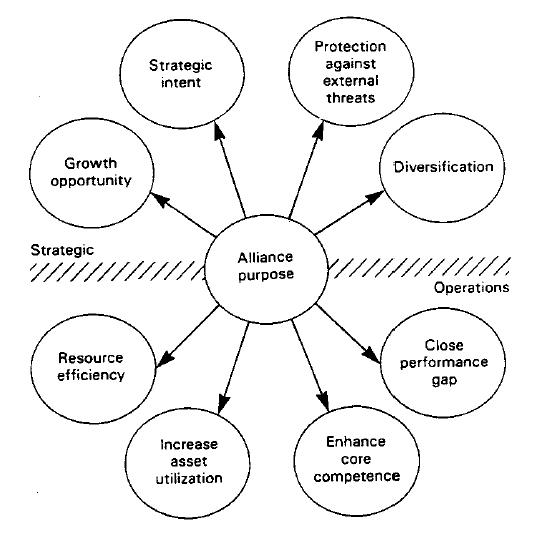

Along with the alliance purpose, also important to our conceptualization are the parties to an alliance and their role definition. The parties to an alliance can comprise of those with whom a company already has ongoing relationships (customers, suppliers or competitorsl5]) or those with whom there is potential for a relationship (potential customers, potential suppliers and potential competitors). Potential customers, suppliers and competitors may provide synergistic pay-oils from complementary support and integrative linkages to business. Figure 2 shows at least eight parties with whom companies team up by forming business alliances.

On a broader level, customers, suppliers and complementary consociates (potential suppliers and customers) can be considered as non-competitors in an alliance and. existing competitors mew entrants, substitute producers (indirect competitors), and companies with similar future intent (potential competitors) can be grouped as competitors6. Thus, we can categorize business alliances as those formed with competitors or those with non-competitors for either strategic or’ operations purpose. Based on these dichotomies, we can now develop a typology of business alliances.

Typology of Business Alliances

Given the dimensions of alliance (purpose and parties) and their dichotomous levels (strategic versus operations, competitors versus non-competitors), we can categorize business alliances into four types: cartels, co-operatives, collaborative and competitive balances. The four alliance types are shown in Table I.

Table I

Purpose of Alliance

Alliance Parties

Cartels are formal (or semi-formal) agreements among competitors for operations purpose, for example controlling the supply of products, fixing prices, or sharing a common infrastructure. Cartels have been known to operate in case of petroleum, diamonds, semiconductor chips and chocolate producers. They are more prevalent in Europe and Asia because existing anti-competitive laws allow these alliances to maintain industry efficiency.

Alliance between non-competitors for operations purposes usually results in co-operative arrangements. Partners share costs and facilities with customers or suppliers or other consociates in order to introduce operating efficiency. Modification of the customers’ or suppliers’ systems or procedures, sharing of relevant information, and multiple level two-way contacts are common in cooperative alliances. Examples of co-operative alliance include the co-operative marketing programme between WalMart and Procter & Gamble. Citibank’s credit card and American Airlines frequent flyer programme. IBM and Sears co-operation to market Prodigy, and the warehouse service venture of Lever Brothers and Distribution Centers. Inc. for operation of high-tech dedicated distribution centre at Columbus. Ohio. The oldest form of co-operative alliances are, of course, the farmers’ co-operatives and industrial buying groups.

Competitive alliances are business ventures between strong rival companies that remain competitors outside the relationship. Most of them have well defined strategic objectives and are designed to serve global or regional markets. They see the virtue of leveraging combined resources and capabilities of each other. Even the largest global companies including General Motors, Toyota, Siemens, Philips, IBM, General Electric, Mitsubishi, and several others, find the world too large and competition too strong to do it alone. General Motors and Toyota assemble automobiles; Siemens and Philips develop semiconductors: Canon supplies photocopiers to Kodak: Frances Thomson and Japan’s JVC jointly manufacture VCR.

Competitive alliances are usually based on reciprocity; partners offering Formation complementary products facilities, skills and technologies. Generally a partnership among equals, most competitive alliances are related to the core business of the partners. Their form is flexible to suit the need of the protect or programme and the relative contributions of the partners.

Collaborative enterprises are formed by non-competitors for strategic purposes. Joint product, market or technology development and joint marketing efforts are the hallmark of collaborative enterprises. Usually the scope of alliance is broad and encompasses mare’ functional areas. The epitome of such collaboration is a fusion of partner objectives and efforts. The most popular form of collaborative is joint ventures [7]

Since uncertainty and trust are manifested in alliance purpose and parties we can observe its incidence in different degrees in each alliance type Collaborative enterprises are likely to be formed when external uncertainty is high and partners mist each other significantly. When uncertainty is low and partners trust each other, co-operative ventures are most likely to be formed. Competitive alliances would be considered most appropriate when uncertainty is high but partners do not trust each other enough. And cartels will be the likely alliance form whenever there is low external uncertainty and low or medium level of trust.

Organizational Properties of Business Alliances

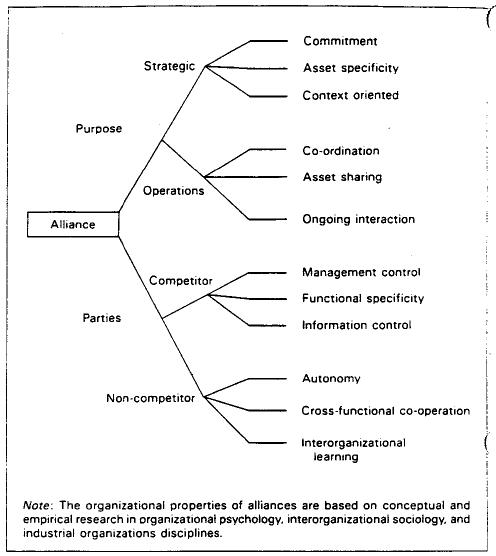

Organizational properties of business alliances will vary significantly depending upon the purpose of. and parties to the alliance. In Figure 3, we have listed a number of organizational properties that are directly linked to strategic versus operations purpose and to competitor versus non-competitor parties to a business alliance. Most of this is based on existing conceptual as well as empirical research.

We know that strategic purposes result in greater commitment a higher level of asset specialist and are based more on context and case-by-case. Therefore there is no real learning curve from one strategic alliance to the next. It is therefore, unwise to rely on one successful strategic alliance as a guide for future alliances. This is the experience of General Electric. AT&T, IBM and Motorola in their global strategic alliances.

On the other hand, operations purposes result in a high degree of co-ordination and asset sharing, on an ongoing basis. This is the experience of Whirlpool in appliances buying groups in retailing, pharmaceuticals and agriculture, as well as more recently the joint quality efforts between suppliers and customers.

If competitors are parties to an alliance, we know that there will be a high degree of management control and it will be limited to specific functions and tasks. Neither party will encourage an open-door policy even though each is interested in learning from the other. This is because there is lack of trust in each other.

Figure 3

An Organizational Map of Alliance Properties

Finally, if non-competitors get together in a business alliance, mutual trust is high. This encourages a greater degree of autonomy for the alliance, free flow of information, and better cross-functional co-operation between alliance partners.

This description leads us to state the following propositions (see Figure 4).

Propositions 1

Successful strategic alliances (among competitors or non-competitors) will require a high degree of commitment among alliance members and greater asset- specificity dedicated to the alliance. Furthermore, strategic alliances will be context driven and, therefore, each alliance must be organized as a unique business venture to achieve its strategic effectiveness.

Proposition 2

A successful operations alliance (among competitors or non-competitors) will require a high degree of co-ordination and asset sharing on an ongoing basis. Furthermore, operations alliances will require re-engineering of business processes of alliance members to achieve their operational efficiency.

Figure 4

Properties of Alliances

Proposition 3

A successful competitive alliance (fur strategic or operations purpose) will require a high degree of management control and will be limited to specific functions. Furthermore, it must be organized for mutual learning among competitors.

Proposition 4

A successful non-competitive alliance (for strategic of operations purpose) will require a high degree of autonomy to the business alliance and cross-functional co-operation and learning. Furthermore, it must be organized in a way that encourages free flow of communication.

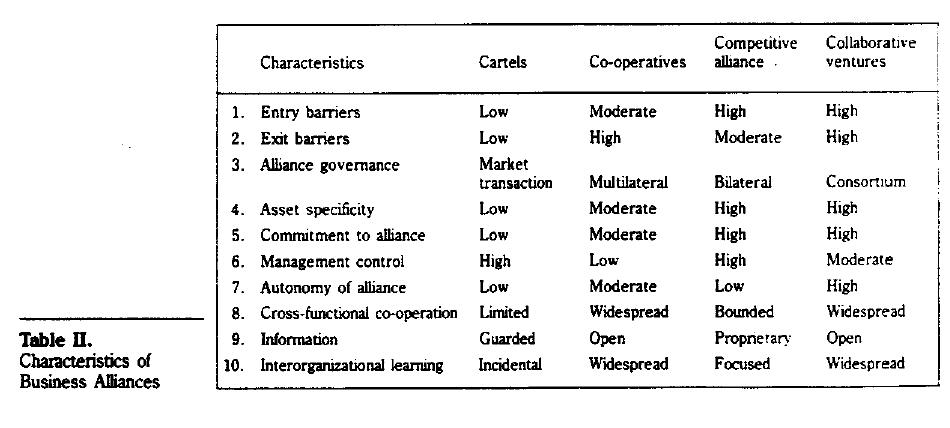

Characteristics of Business Alliances

Each type of business alliance (cartels, co-operatives, competitive alliances and collaborative ventures) is likely to have its own unique set of behavioral economic and managerial consequences. It is, therefore, possible to use this profile as a benchmark against which one can judge the performance of as a specific business alliance in each category. Table II lists ten benchmarks for each Business alliances.

Cartels

Operations alliances among competitors are likely to experience low entry barriers, especially in an oligopolistic industry where business processes are standard and regulation allows sharing of resources for efficiency reasons. Conversely, it is relatively easy for a member to exit a cartel if economies of scale and scope justify doing itself, rather than sharing in the cartel resources. Therefore, transaction cost theory (Williamson, 1975) and market governance are likely to determine the continuation of cartel alliances.

As a consequence, commitment to the cartel alliance by any member organization likely to be low, and cross-functional co-operation will be bounded to specific functions, departments and activities as specified in the cartel alliance. At the same time, management control and involvement will be high even though the cartel alliance is allowed to operate at arm’s length in a semi-autonomous manner. Finally, communications among the alliance members will be guarded and intetorganizational learning will be limited and focused on specific operations areas (R&D, manufacturing, marketing, logistics, customer service. etc.).

Co-operations

Operations alliances among non-competitors are likely to have low entry barriers because regulatory, emotional and business processes will not inhibit their formation. However, once co-operative alliances are formed, they are likely to generate strong exit barriers this to operational alignment and each member’s inability to economically justify their own dedicated resources to replace the shared operations. The governance mechanism will be multilateral or consortia.

Table II

While the commitment to the co-operative alliance will be modest, and only limited resources will be dedicated to it, theme will be widespread cross-functional co-operation and sharing of information about one another through open Business communication. Consequently, co-operative alliances will result in widespread intetorganizational learning.

Competitive Alliances

Strategic alliances among competitors will experience high entry barriers especially due to regulatory and emotional roadblocks. The historical rivalries among competitors will make them less comfortable to Co-operate in the future. For example it will be more difficult for General Motors and Ford Motor Company. or Coca-Cola and Pepsi. to get together in an alliance than for them to get together with non-competitors from other industries. Even if they do get together. let us say, at the urging of government policy or customer demands the competitive alliance will be fragile and likely to dissolve quickly because the exit barriers are likely to be relatively low. The governance mechanism is likely to be bilateral, because it will be extremely difficult to bring together two competitors due to the possibility of a coalition against member. For example, recently the computing industry tried to create alliance between Honeywell. Bull and NEC but it laded. Similarly, a consortium of United States memory chipmakers (MCC) laded, probably for the same reasons.

Because the entry barriers ate high and exit barriers low in a typical bilateral competitive alliance (GM-Toyota. IBM-Apple, GEThomson Motorola-Hitachi. etc.). it will demand a high degree of commitment to the alliance, and greater allocation of resources on a dedicated basis. However management control and involvement will be high, and the autonomy granted to the alliance will be limited. Finally, cross-functional co-operation will be bounded and limited, communication highly guarded and interorganizational learning will be focused to the purpose and nature of the competitive alliance.

Collaborative Alliance

Strategic alliances among non-competitors will experience high entry barriers because strategic purposes may not be convergent or business processes cannot be utilized for future market or technology developments. This is especially true in joint ventures and technology transfers between advanced and developing nations, for example. between the United States and India or Western Europe and Eastern Europe. Similarly, once a collaborative alliance is formed, it will be difficult to leave the alliance. This has been a common experience of many joint ventures, especially in the international context. The common governance structure is to form a trilateral or a small group consortium among non- competitors for future business development. Recent formation of consortia in the telecommunications industry,’ to participate in the worldwide growth unity are good examples of this phenomenon.

Commitment to the collaborative alliance will be high and economic and physical resources will be dedicated to the alliance (usually by creating a joint venture). It will be given greater autonomy and management control and involvement will be limited to financial performance similar to the portfolio management approach. Finally Cross-functional co-operation will be widespread International communication open, and interorganizational learning will be high among the alliance partners.

Future Directions

In this article, we have attempted a theory of business alliance formation based on purpose (strategic versus operations) and parties (competitors versus non-competitors) to alliance formation. Underlying these variables are the powerful constructs of uncertainty and trust. The uncertainty construct is anchored to risk assessment and risk sharing, whereas the trust construct is anchored to intent, opportunism and self-interest. Since trust and uncertainty have not been satisfactorily operationalized ‘in organizational psychok industrial organizations and interorganizatioriai sociology, we have chosen party (competitors versus non-competitors) and purpose (strategic versus operations) as surrogate indicators of trust and uncertainty.

Our future research directions related to business alliances consist of the following:

(1) What are the specific operations and strategic purposes most common in forming alliances? While we believe that most operations alliances (cartels and co-operatives) will be for efficiency Improvements, we do not know specific areas of business inefficiency that will motivate organizations to get together for efficiency and productivity. We suspect that, in the past, this efficiency issue was focused on manufacturing operations but, as they have become more efficient, it may be more attractive to form operations alliances for support functions (information systems, human resources, logistics, training. etc.) and in R&D engineering, and customer service operations of the business.

Similarly, the most common reasons for strategic alliances (competitive or collaborative) historically have been focused on international market opportunities and domestic market protection. Once this is accomplished the future strategic alliances may focus on reducing the technological. political and economic barriers prevalent in a given industry. Also, we believe that future strategic alliances may be organized for process reengineering, setting global standards, and development of new industries (for example, ecological business).

(2) Another area of future research is the governance principles of business alliances. What governance mechanisms are appropriate for each type of business alliance and can we develop “best in practice” benchmarks that can be used to role-model similar types of business alliances? For example, which cartels, co-operatives, collaborative and competitive alliances are worth emulating for other cartels, co-operatives and competitive alliances?

(3) We know that business alliances like all organizational arrangements are dynamic and evolutionary. What is the evolution of a specific business alliance? Is there a life cycle (birth-death) theory of business alliances?

For example, competitor alliances (cartels and competitive alliances) as Business they develop mutual trust. may behave more like non-competitor alliances Alliance (co-operatives and collaborative alliances). On the other hand, if they do not build mutual trust, they are likely to be dissolved through exit or acquisition process.

Similarly, all operations alliances (cartels and co-operatives) once they achieve business efficiency are likely to focus on strategic purposes and, — therefore evolve into strategic (competitive or collaborative) alliances. On the other hand, alliance members may feel that there is no common strategic goal and, therefore, the operations alliance may be dissolved by group consensus and let it die by not renewing the alliance agreement.

Notes

References