By Jag Sheth with Bill Wallace | The information industry is convulsed by explosive technical change, and radical restructuring. And it is no good looking to the customer alone for guidance. Jag Sheth argues that the changes are too swift, and too profound, for the customer to be able to express the full range of options.

When mains electricity first became available for industrial and domestic use many firms went out of business. The steam-engine, once the dominant source of energy became obsolete, suppliers of gas- lighting went bust, and the writing was on the wall for a whole range of domestic services, ranging from laundry to ice-making.

Digital technology — converting all information into 1s and 0s — represents a similar step change for the communications and information industries.

If mains electricity is easily distributed energy, instantly convertible into light, heat or power, digital technology creates homogenized, easily delivered information that is instantly convertible into whatever form the user chooses.

And there is nothing trivial about the ‘multimedia’ industry it is creasing. John Sculley, former CEO of Apple Computer, says it could be womb $3 trillion a year, by the millennium. Few industries will be untouched by its gravitational pull.

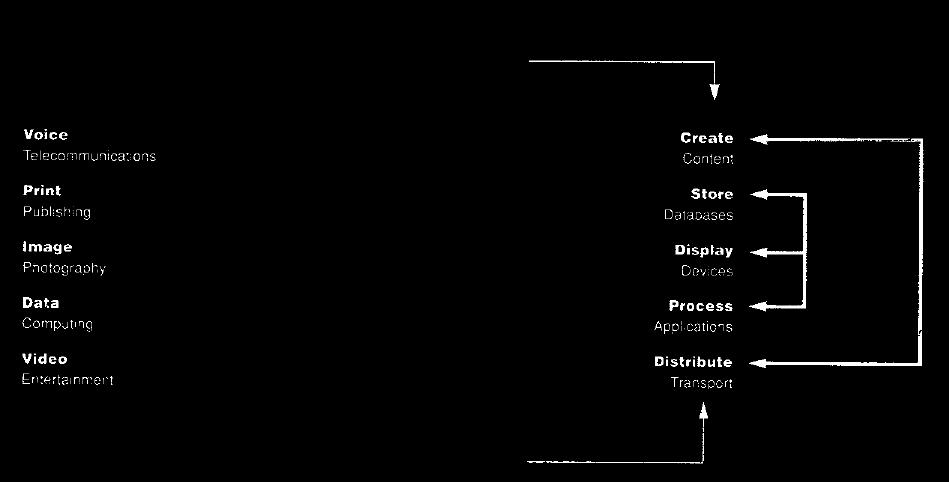

But its components will be dismantled by digit al technology, and then reassembled in unfamiliar configurations. In the past, industries were structured around the form of information:

- Phone companies supplied voice communications.

- Publishing companies generated and printed text.

- Cable companies delivered video programming.

- Computer companies manipulated and stored data.

- Photographic/xerographic companies captured and reproduced images.

With digital technology any information, irrespective of its original form can be delivered through almost any medium and it is the user who decides which form it takes, and where, and how it is displayed. For communication, processing, storage, and display, all information is composed of the same ‘stuff’ — just a series of 0s and 1s.

If follows, therefore Forms will survive, but will be convertible into each other, using functional capabilities (See Diagram 1).

We believe the switch from form to function- based competition spawning products such as on-line services. CD-ROM based multimedia home computers and Interactive Multimedia (IMM) sent over domestic phone lines, is the essence of convergence.

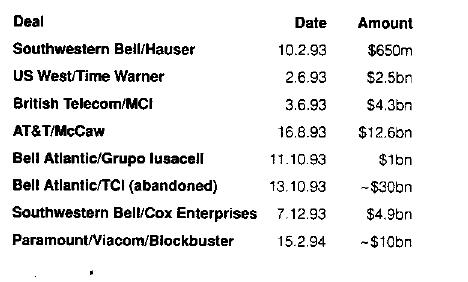

The influence of such ‘function-thinking’ is apparent in the recent explosion of investment announcements and deals (sea box over the page). By June 1993, the magazine, Digital Media had counted no fewer than 384 multimedia driven deals.

Battles for Functional Leadership

This manoeuvring is best seen as the consequence of efforts by players to re-position themselves within, and across five functional areas:

Create (content)

Store (databases)

Display (devices)

Process (applications)

Distribute (transport)

The plays can be classified into four types of manoeuvring.

Content Consolidation

The lengthy auction for Paramount was a struggle for control of ‘content’, which remains a relatively limited resource. One bidder, QVC, has substantial interests in broadcasting to the home, through its home shopping network. It seems to have reasoned Paramount would extend its content portfolio, and so increase its bargaining power, with increasingly consolidated ‘transport’ players.

Paramount’s victorious suitor, Viacom, which has substantial interests in cable, seems to believe. Paramount content will add a key, vertical dimension to its distribution capabilities.

That both suitors formed radical alliances to obtain finance speaks volumes for the importance placed on ‘content’, and the size needed to achieve operational economics of scale (e.g. global production. and data gathering capabilities) and to spread the risks associated with content production.

Transport Consolidation

Similar convergence plays are occurring in ‘transport’. The largest was Bell Atlantic’s abandoned $33 billion merger with cable TV giant, TCI, which would have provided Bell Atlantic (BA) with at least three major benefits.

First, it expands BA’s ‘transport’ reach beyond its regulated arcs, into TCI territory. Second. it advances BA’s long-term strategy of offering interactive, broadband services to the home, carrying voice, data and interactive multimedia over hybrid fibreoptic and coaxial networks. Third, it moves BA into the areas of content creation through TCl’s subsidiary, Liberty Media. Once again, digitization is permitting the sending of more forms of content through the same ‘pipes’ and so enabling BA to seek to become rise pre-eminent ‘pipe’ into American homes, even without TCI.

The purchase by British Telecom (BT) of a $4.2 billion stake in MCI provides more than entry into the US market, through an unregulated carrier. MCI intends to enter the local loop market, and team up with computer giant IBM to build ‘ramps’ to ‘information superhighways’.

This will extend MCI/BT’s reach directly to the US consumer and will provide the scale economies, and ‘single-point-of-contact’ branding, needed to attract communications, and information managers of large global firms.

Consolidation Of Storage And Devices

In devices, with which all TVs are expected to be equipped. Early leaders in the US are Scientific Atlanta (serving Time Warner/US West and Viacom) and General Instrument, but major companies, such as Philips, Thomson, Hewlett-Packard and Hughes are very much in the running.

More interesting are function-spanning consort is such as the group backed by AT&T. which includes General Magic, EO, 3DO, Compression Labs and Apple and the Cablesoft Group, bringing together Microsoft, Time Warner and TCI.

The leader in the race to provide storage capability appears to be Oracle. It has teamed up with DEC to develop a video server for US West, and is developing hardware with nCUBE, a small maker of

massively parallel processors. Its strategy seems to be to develop a solution for all multimedia storage needs by extending its expertise from data to video, and all other forms of content.

Distribution Reaching Into Content

The interest transport firms have shown in content is based on a belief that content and transport are a natural fit and that transport companies will be stronger if they own, or have assured access to, high- quality content.

Examples of this thinking, include NYNEX’s and Bell South’s involvement in courting Paramount, TCI’s re-acquisition of Liberty Media just days before the merger with Bell Atlantic was announced and Southwestern Bell’s venture with Cox.

The New Industry Structure

The function model (Diagram 1) suggest that live businesses will emerge from today’s information industry, but this may be reduced to three, as customers begin to use and rely on the new multimedia services.

According to this scenario, the new industry will consist of companies specializing in networks, devices or content.

‘The network businesses will evolve from simply providing the transport conduits, to include, not only the distribution of multimedia services but also the supply of value-added information processing. At the same time, the devices businesses will grow to encompass, not just simple display but also the storage of multimedia information.

Content creation will remain separate from these activities, but will be the industry’s powerhouse, however the multimedia services and applications it creates are distributed.

Investment In The Information Industry

The pace and scale of deals in the US information and entertainment industries have increased sharply, since the beginning of 1993.

Given the technology’s ability to transcend national borders, it seems probable the core businesses, whether five or three in number, will be organized globally, and given the digital homogenization of all information, the wide availability and rapidly falling price of hardware and the dramatic drop in the cost of digital transmission, it is safe to assume users will need access to multimedia content, wherever they arc and whenever they desire.

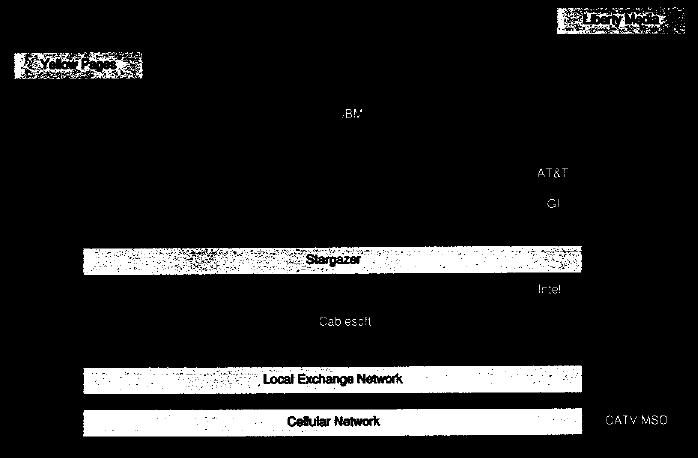

The case of Bell Atlantic illustrates how a large firm with a strong position in one form-function area, steered itself into a wider strategic space.

It expanded within its original function, transport, and now provides data and wireless services in addition to traditional voice services. Moving outside transport, Bell Atlantic provides text content through its Yellow Pages group and has alliances with device manufacturers such as GI, and with applications developers like Cablesoft (see Diagram 2).

BA appears to have escaped the fate of remaining a commodity provider of low value-added voice services in a limited geographical area. Instead, it will supply digital information, in various formats. For example, a natural move would be to digitalize Yellow Pages and make it accessible through the network. BA would then be creating content, digitizing and storing it (perhaps in partnership with a company like Oracle) transporting it, and displaying it on a device, such as a TV set (through a ‘teleputer’).

The mapping of Motorola (see Diagram 3) shows an emphasis on its radio frequency (RF) engineering strengths; devices and transport (such as the Iridium satellite venture). Participation in application alliances such as Kaleida and General Magic, suggests Motorola hopes to shape applications development thereby helping to set standards that are compatible with the devices it manufactures.

Competing In a Converging World

Form-based industries are crumbling and re-assembling rapidly. The changes occurring in the global information industry are so radical and competition for the territory they are mapping out will be so ferocious, that the survival of no company is assured.

Even companies which are ‘best to class’ may find they need to change dramatically. And they will be competing against not only familiar rivals, but a whole new breed of adversary; all companies capable of creating, manipulating and transporting digitized information in new ways.

It is clear that, to succeed in the information industry, in the era of convergence, companies will require an ability to spread functional capabilities across all types of form. And it is likely that breakthrough success will require expertise or assured access to expertise, in several functional areas. There are four principal requirements for CEOs if they are to exploit the opportunities and avoid the pit-falls created by convergence:

- Understand the trends

- Establish your strategic intent

- Explore the ‘white spaces’ in the convergence map

- Form alliances, or acquire, to develop your position.

Understanding The Trends

The difficulty for trend-spotting, in a converging world, is that trends emerge from the cross-cutting currents of ‘form’ and ‘function’.

As you seek opportunities to move across form or functional boundaries, other companies will be cycling your territory. Competition will be global. European and Asian firms have bought stakes in the US (BT’s share in MCI, and Sony’s acquisition of Columbia Studios), and US firms have done the same in Europe and the Pacific Rim (US West’s moves into Hungary, with its cellular service, and into the UK with its PCS alliance).

Establish Your Strategic Intent

Once you understand the trends and you have developed firm points of view in key areas, what will your game plan be?

Should you expand within a function, building on your existing competencies to cross the form

boundaries and ‘own’ a function, much like owning an operating system?

Do your competencies equip you to enter another layer, now, or when you have broadened your own functional base?

Do horizontal or vertical moves seem most promising?

The answers to such questions require a, reframing of the way you and your staff think about your business. You will need to articulate a new and ambitious strategic intent for the future which will require people to think and act outside the form-based space with which they are familiar.

Explore The White Space In The Convergence Map

Which moves arc easiest to make, and which have the greatest potential?

You can probably outline your current position. on the form-function map, quite readily and. if you have done some strategy work, you know if you warn so move horizontally, vertically, or both.

It will be clear you have various opportunities for matching your core competencies with those of potential partners. As professors Gary Hamel and C K Prahalad have noted, however, the best opportunities for revitalizing your company, and growing new businesses, may lie at the intersections between businesses. In this context, rise moves by Sony, Bell Atlantic and others can be seen as plays to fill form-function white spaces, and create growth opportunities, greater than those available to their core businesses.

As you reposition, you should pay close attention to the implications for restructuring. Long-established divisions of the existing business may not fit the new idea. For example, for a publishing company wanting so re-position as a vendor of digitized information, a printing plant may be superfluous.

Part of a CEO’s responsibility, during periods of industrial upheaval, is so ensure appropriate re-skilling opportunities are made available, so that employees who have served the firm well can adapt to the new environment.

Form Alliances Or Make Acquisitions To Expand Your Position

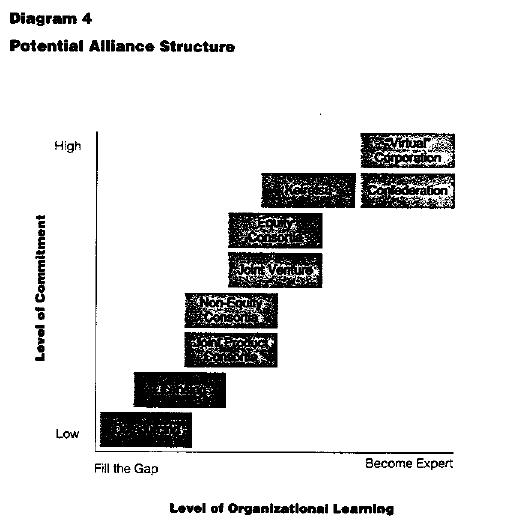

You may be able to occupy new, strategic positions with your in-house resources. However, it will often be faster to team up with other companies.

Alliance building is a complex art It requires the matching of cultures, resources and expectations, and for it to make money for the allies, the alliance must serve the customer better, as a whole, than the partners could do individually, and better than any other corporation (or alliance) can do (see Diagram 4).

Three management processes can help ensure that your alliance succeeds:

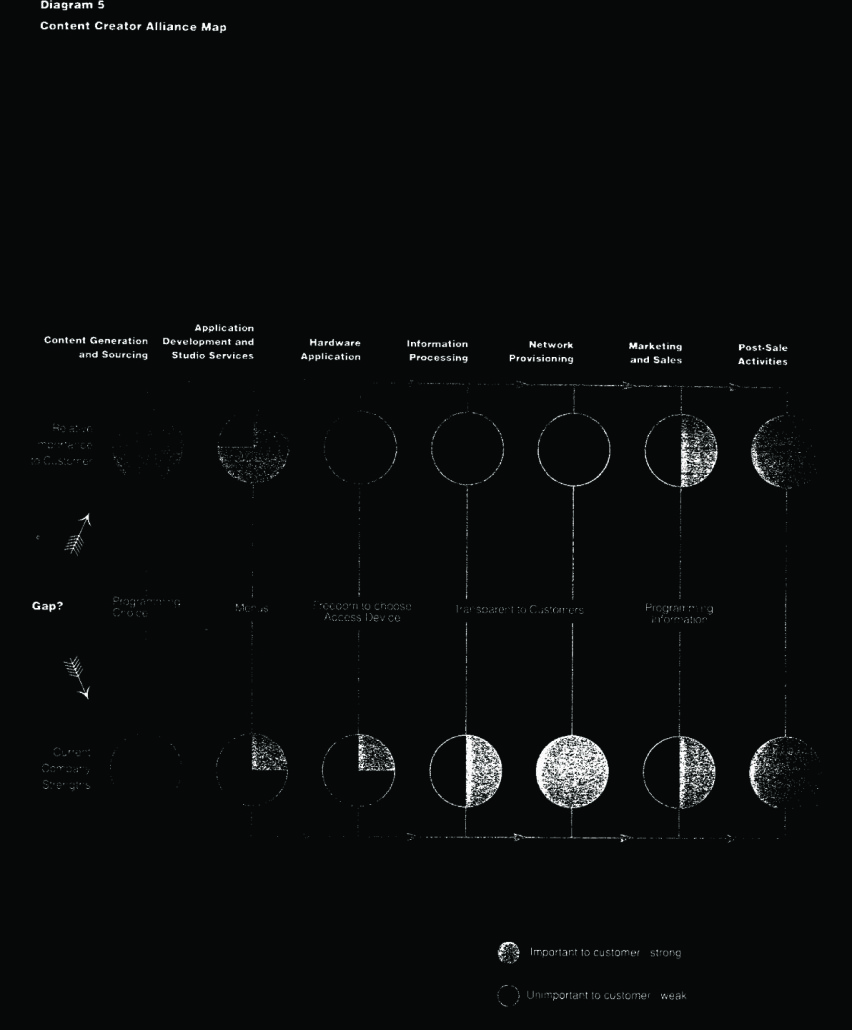

the ‘alliance map’: identifying clear customer benefits from enhancing and blending the core competencies of the partners (see Diagram 5).

‘hyper processes’: she quickest to learn wins protect the ‘soft underbelly’ of alliances.

Creating An Alliance Map

Draw a picture of your value chain, and the gaps between the needs of your customers, and your abilities. This makes you focus on things that arc important to customers, and reveals the Opportunities offering the meet potential for alliances.

But be sure to base the value chain, riot on the ‘as is’, but on the ‘to be’ (in the post-convergence era). The next step is to identify partners whose strengths match your weaknesses and vice versa. A good match will bring clear benefits to customers.

Establish Hyper Processes

The purpose of an alliance is to drive major improvements in the industry which the allies could not achieve individually and which competitors will find difficult, or impossible, to match.

This purpose should be articulated through the creation of a clearly defined understanding of mutual strategic intent, If the alliance is to succeed, the vision must be shared by all partners.

Each partner has some of the answer. Together they can find solutions more quickly. This speed crea tes a market-driving position your rivals will find it hard to match, because the fastest to learn (new techn ology or new market approaches), wins.

Protect the Soft Underbelly of Alliances management

Remember that your partners are your equals, and treat them accordingly. Irrespective of size, all partners are needed, or they should never have got together in the first place.

As Jordan D Lewis has pointed out, it is essential that the alliance remains a top priority for all parties, and that quality resources are dedicated to it. Delegate responsibility among the partners, even the smallest. Build crust through consistent personal relationships, at all levels, You must nurture a cooperative outward-oriented culture.

Finally, you must set clear goals for all business processes and monitor performance towards those goals.