Jagdish N. Sheth, Professor of Marketing, Emory University, Rajendra S. Sisodia, Associate Professor of Business, George Mason University

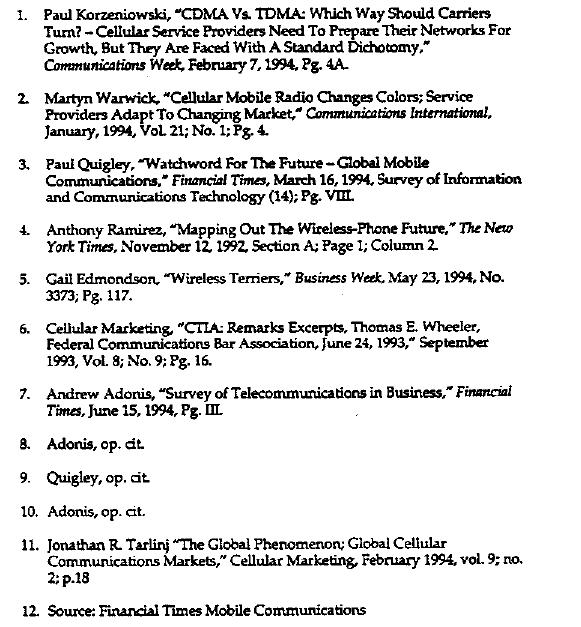

In this paper, we look at the future of the industry. We see several dramatic shifts that are becoming apparent. In particular, we have identified six key drivers of change (Figure 1).

Technology

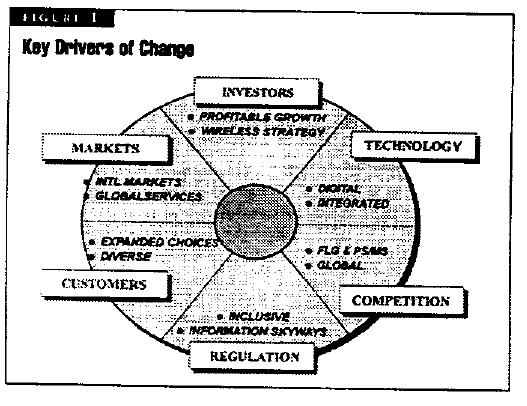

As the move towards digital technology gathers moment um, some fundamental characteristic of the business are going to change (Figure 2). Consider the fact that CSM handsets today have up to 450.000 Lines of computer code programmed into their memories, This illustrates that both the technological thrust, as well the economics of the wireless communication business will increasingly derive from the computer industry rather than the radio industry.

Moving to digital transmission has a two-fold impact on carrier operations. First, carriers can station receivers at greater distances, which means they can buy less network equipment to cover an area. This makes it cheaper for carriers to deploy new services. Second, digital transmissions pack information in bits and bytes; these are simpler to manage than the electronic waves of analog techniques. With digital transmission, carriers can more easily troubleshoot network problems remotely.1

Technological advances are permitting wireless technology to be integrated with wireline services to a much greater extent. Various networks are separated in a commercial sense rather than on technological grounds. Service providers are increasingly being pushed to offer a “one stop shop.” or a variety of competitive services via a tingle billing mechanism; this trend Is bound to continue and accelerate. We expect to see the emergence of communications that will integrate the PSTN and mobile services In a single transparent, and seamless whole.2

For this to happen a number of hitherto separate networks will have to come together in an integrated way- wireline cellular, satellite, FCS, LAN. and broadcast Currently, each of these networks has its own technology and is incompatible with many of the other networks.

Few of us could have predicted the all-pervasive influence that personal computers would come to have in business and personal life over the last decade Yet we are seeing the integration of voice, data, image, and communications in a natural evolution towards the multimedia workstation.

Similarly, emerging technologies in mobile communications have made wireless, mobile, and personal communications one of the fastest growing markets in the world. The range of technologies becoming available is immense. Future wireless and mobile communications systems will blur the demarcation lines between wireless and fixed telecommunications

The speed of developments in the Industry is accelerating. For example, It took cellular phone manufacturers eight hours to make a cellular phone in 1988; 30 minutes in 1992. Today it takes a mere 12 minutes and this Is a telephone containing computer capacity of between 30 million and 40 million instructions per second, equivalent to the power of mainframes of only a few years ago.3

The Impact of Digital Electronics

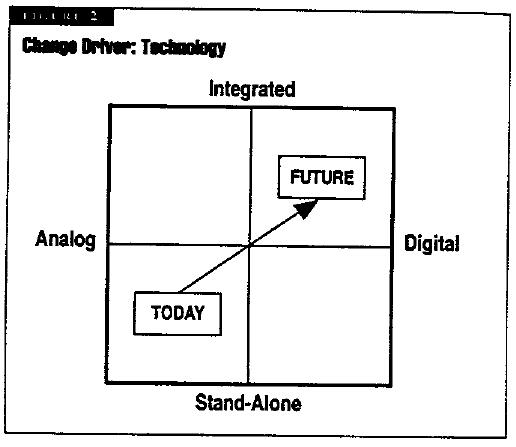

In an electromechanical industry, experience curves move down slowly, and their lower asymptotes (marginal coats) are quite high (Figure 3). Given these slow cost dynamics such industries see no real need to speed things up; they focus on economies of scale rather than economy of time. They tend to emphasize ‘ability and willingness to par’ in determining the order of market penetration and exploitation. Because such Industries tend to be capital-intensive, they allocate capacity to certain segments sequentially. Thus, most such industries first target the government market, followed by the industrial market, commercial sector (small business), and finally, the personal market.

This trickle-down approach worked quite well in an era defined by electromechanical technology dynamics, limited communications, and slow-changing technologies. Under the trickle-down approach, companies do not innovate for the personal market these are treated as hand-me-down markets. The presumption has been that these companies can take care of the personal market (e.g., personal copiers) down the road. This would be all right if the industry were moving slowly in terms of technology evolution or costs; however, when the industry becomes electronic, its dynamics change dramatically.

In electronics, a “trickle-up approach is far more likely to succeed. Electronic-based industries, almost without exception, follow a different experience curve than electromechanical industries (Figure 3). Speed Is the driver, mud mare than scale. The slope Is much steeper and the lower asymptote is close to zero. This effect is most dramatic for software (where the marginal cost is close to zero), but is also very pronounced for electronic components (especially dope) and a little lees so far information products (which have significant electromechanical components. for example. PCs have electromechanical hard drives, floppy drives, power supplies, casings cards, etc., VCRs have tap. transport mechanisms etc.). The greater the extent of solid-state electronics and software-based operation and control, the greater this type of experience curve effect.

As a consequence of these cost dynamics, success in electronics-based industries derives in large measure from an ability to force the experience curve down rapidly by genera ting a large volume of demand in a short time. Hence this calls for a ‘trickle-up” approach to market penetration and development creating demand on a large scale. The largest part of the market Is usually the segment that is least willing or able to pay a premium price.

Companies in an electronic industry that continue to operate as though they were in art electromechanical industry are doomed to failure. By the same token, companies that recognize the economics of electronics and alter their mind- set accordingly will likely succeed.

When the technological base of an industry is both electronic (leading to the trickle up property described above) as well as digital (equating with versatility, I.e., the ability to handle any form of information interchangeably), the implications are dramatic. The former leads to an emphasis on personal markets, which Is where the volumes necessary for cost reduction are, and the latter leads to integration of multiple services on the same platform.

Implications for Cellular Service Providers

As a result of the trickle-up theory described above personal markets will become the lead markets fo technology evolution, rather than business markets. As a result of the versatility and greater capacity resulting from digitalization, personal markets will become multimedia. Personal markets will become universal through global standards. Voice-video-data evolution Is more attractive in personal markets than voice-data-video evolution.

The Economics of Electronics

Since technology performance-price improvements will likely continue at a rapid rate investment cycles will also be rapid. As we evolve towards a “network of networks, the wirefree and wireline aspects of the Industry will increasingly converge. The long-run evolution will be towards global multimedia networks.

As network capacities expand dramatically, Service providers will have to revise their normal pricing formulas. Rather than use cost-based pricing, as has been the practice, service providers will use price-based costing, i.e., they will set prices with a view to maximizing revenues (since variable costs will be low) and then ensure that their cost structures enable them to make a profit. Market demand will have to be exploded” through the aggressive use of penetration pricing at the low end of the market and value-based pricing for other customers.

Besides surpassing institutional markets in revenues in each information business, personal markets will also become multimedia in each business. Further, they will become universal through the emergence of global standards. Convergence will take place in networks as the various parallel systems overlap, interconnect, and ultimately join in a seamless structure.

Finally, compatible technology standards will result in a more level playing field, making it harder for any one company to achieve a relative competitive advantage. This shift to generally comparable systems will have a number of implications. Service providers will find it increasingly easy to substitute vendors. We are already seeing this phenomenon as carriers shift from one wireless switch provider to another and then back again. Off- the-shelf components will change the relative Importance of hardware. Moving iron will give way to systems and solutions selling with commensurate changes in engineering, sales, and distribution. Software that customizes the basic platform will be more important than the platform itself.

Competition

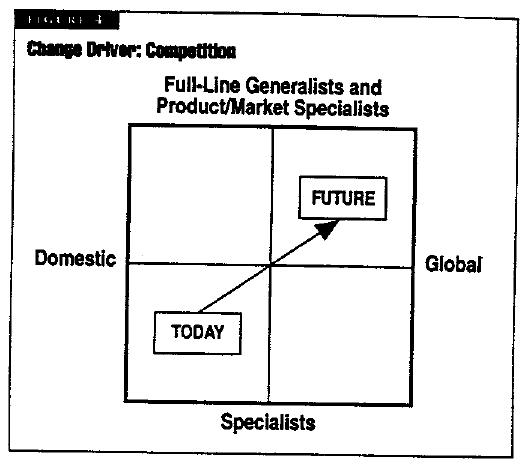

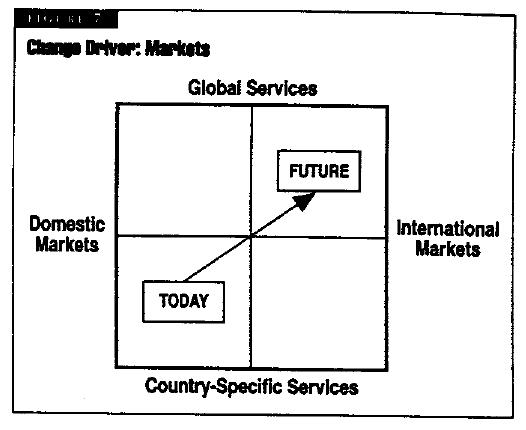

Thus far, competition in the cellular business has come primarily from domestic players who are either pure cellular specialists or have a limited range of communications offerings (such as cable television or local telephony). As we go forward, however, this is likely to change (figure 4)

Increasingly we are likely to see the presence of global competitors in the U.S. market British Telecom already involved, via its ownership in MCI. NTT has a stake in Nextel. France Telecom and Deutsche Telecom ate seeking to acquire a stake in Sprint As other countries liberalize their telecommunications regimes and allow U.S carriers entry into their domestic markets, carriers from these countries will also be gives greater a to the U.S market The protection afforded wireless providers via the 1934 Communication Act provisions on foreign ownership will likely diminish over tans, and no such regulatory advantages are likely to persist.

That this is likely to occur can be seen from the strong position already enjoyed by U.S. carriers (mostly the RBOCs) in providing wireless services abroad. Global carrier will demand and eventually receive similar access to die U.S market.

Over the next few years, after Congress completes its overhaul of the 1934 Act, some of the larger local and long-distance carriers will be increasingly likely to become fuII-line generalists’ i.e., providers of a range of communications services to a variety of different markets, including local and long-distance calling, wireless voice, data, and video, and interactive cable television. Other players, lacking the scale and scope to compete as full-line generalists, will position themselves as either product specialists or market specialists.

Strategies for Generalist vs Specialists

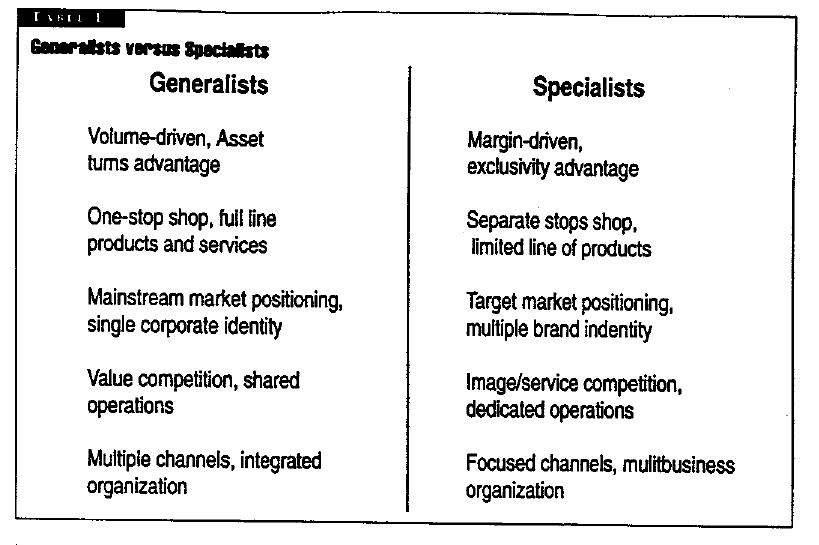

Successful generalists and specialists follow different strategies and have very different operating characteristics, as depicted in Table 1.

Generalists are large, volume-driven players, dependent on economies of scale and scope for much on their competitive advantage. They have large fixed assets in place and their success depends heavily on their ability to maximally utilize those assets. In other words, the ability to generate substantial revenues on a given asset base is crucial.

Specialists, on the other hand, eschew volume and velocity in favor of hi5l margins (revenue minus cost), It Is Important to point out that high margins do not necessarily imply high prices. Southwest Airlines, for example, is a specialist that achieves its attractive margins (far above market averages) through aggressive cost cutting. Other successful specialists have achieved high margins by combining average cost structure with an exclusivity advantage—a form of differentiation others cannot emulate.

Regulation

About the state of competition in the cellular industry, a former senior official of the FCC, Albert Halprin, the nation’s top telephone regulator in the mid-1980s said: The amount of competition is not what I would have hoped foe. ‘Mistake’ Is far from the right word to describe our action, but it was not perfect. With hindsight, we should have authorized a third carrier.4

A report in 1993 by the General Accounting Office, the investigative arm of Congress concluded that the current duopoly arrangement in place in most areas was unlikely to provide a product at a competitively set price.

Likewise, in the United Kingdom, the government concluded after a lengthy duopoly review” (which covered Wired as well as wireless communications), that it would be necessary to open the market to many more players in order to foster greater competition. As a result, the UK already has five cellular/PCS networks, and dozens of companies competing in various parts of the wire line market

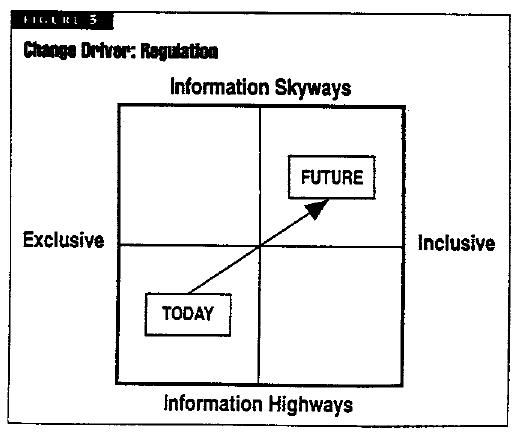

As a result of these developments, the regulatory regime in the US has become strongly driven by the concept of inclusion rather than exclusion (Figures). In other words, regulators will take every possible action to ensure that no telecommunications service providers of any kind given any kind of exclusivity over the provision of any services. Rather, regulators will try the entry of as many players into as many markets as possible.

For incumbents, this represents an opportunity as well as a threat. It is virtually certain that they will face heightened competition from additional players in their core business. At the same time, they will be presented with numerous new opportunities to extend their competencies into new products and new markets. Those unable to compete on these terms will no longer be protected from decline.

European telecommunication regulators, who have traditionally lagged the U.S. in opening markets and loitering competition, are moving rapidly to deregulate cellular services and increase competition. The European cellular industry, deregulated in the late 1980, is now a role model for Europe’s regulated businesses. The European Union recently recommended that any remaining exclusive mobile licenses be eliminated by 1998. It also recommended allowing mobile operators to build their own lines to connect cellular stations with land-based telephone networks, avoiding hefty leasing lees from state-owned carriers. Such changes may not be legislated anytime soon, but they signal a sea change In attitudes among regulators.5

A shift in regulatory mindset is contingent on some technological vectors developing as expected. The widespread assumption that wireless communication will always be inherently suited to narrowband communication is starting to be challenged. The assumption owes much to an assertion by Nicholas Negroponte of MlT’s Media Lab that there will be a switch in how voice and video information is promulgated. Negroponte suggested that what goes over the air will go under the ground, and what goes underground will go over the air.

This zero-sum view of spectrum is being challenged by technological changes. Thomas Wheeler of the CTIA has expressed this view as follows:

Wireless digital devices hay, a basic limitation they operate on the current narrowband wireless and wireline network. They cannot handle the high speed broadband digital data of many modem compute, applications. A fiber optic network I. only pan of the solution to the information infrastructure needs of the 21st century. While there is a great deal of policy focus on building a broadband, wired er network, these is no such equivalent focus on a wireless, broadband network, intact, there is the possibility that pending government action could inhibit the construction of the wireless equivalent optical fiber. Broadband, 21st century wireless networks can be built quickly arid In the public interest.5

There are huge amounts of frequency spectrum available above 20 GHz. Spectrum scarcity will thus become less of a factor, and we will eventually see broadband on wireless. For example, the Teledesic plan propounded by Bill Gates and Craig McCaw will provide “gobs of spectrusn—400 MHz per carrier.

We believe that this vision of “information skyways” will be accepted by regulator,, who will take actions to facilitate the creation of broadband interactive wireless networks, For example, wireless cable provider Cellular Visions system has around 300 duties the bandwidth of conventional broadcast television, and even more than the average cable system.

Customers

The present state of the mobile phone market has been likened to a thin sandwich in search of a thick filling. Two thin slices of the business, market are currently being serviced—namely senior executives on the one hand, arid traveling sales people plus the self-employed ‘roamers (plumbers. electricians, and so on), on the other.”7

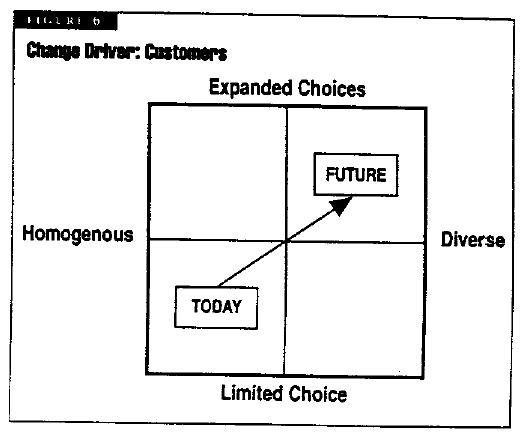

In between lies the bulk of the population the vast majority of which is still largely untouched by this technology. In the future, wireless telephony are expected to penetrate both the business, and the consumer sectors in parallel, one reinforcing the other as prices fall ultimately, and the time Is not too distant, mobile phones will come to be regarded as necessity We are thus moving from a situation In which the market is relatively homogeneous to one In which the market will consist of many different segments (Figure 6).

Customers lot coming years will find that they have many more choices for wireless communication than they do today. We will also find that customer needs will vary greatly. This will be true as customers. In this section, we will examine the divergent needs of consumers and businesses separately.

Consumer Markets

The primary source of new demand for full-line telecommunications companies (such as an RHC) will shift from business customers to consumer markets. Supported by the underlying technological change and Investor growth expectations, cellular carrier will have to look increasingly to the consumer market for revenue growth.

Future consumers will be dramatically different from past or even present consumers. They will be more demanding, more time driven, more information intensive, and highly individualistic. Their communication needs will thus become highly divergent. It is no longer possible to stereotype consumers into a single image or category such as “middle class America.” Some of them are happy with basic service. Many more of them seek information products and services that free them from being hostages of time and place. Their interests will drive product and service development the cordless phones and answering machines of today will become the personal communicators and voice mail services of tomorrow.

The following discussion covers shifts in behavior and economics that will shape consumers and the implications for telecommunication service providers and ultimately equipment suppliers. Our examples are drawn largely from the United States since that is where the process is most advanced. However, the same forces are at work throughout the industrialized world.

Behavioral and Economic Shifts

As a consequence of lifestyle and demographic changes the following will be some of the fundamental behavioral and economic shifts among consumers:

Growth in service sector — The older affluent population’s concerns for health, security and recreation combined with single-person household requirements will maintain the growth in services.

Scarcity of time — Time will become the most precious commodity. As activities compete for time, we will redesign tasks that consume too much time, and embrace time-shifting technologies. Customers will demand hassle-free (“get it right the first time”) service.

Decline of homogeneous markets – Population diversity in age, geography, income, household characteristics, and ethnic mix point to the emergence of segmented, niche markets. The days of the mass market are over.

Development of individualistic lifestyles – As single-person or dual-career households proliferate, the need to define a separate existence or space will result in highly individualistic lifestyles and behaviors even within family units. This will increase the need for personalized attention to each household; telcos will thus have to learn the skill of mass customization.

Scale of buying power — Growing buying power will put consumers in the driver’s seat, dictating the development of new markets. While business markets will continue to expand consumer spending will become an ever larger part of GOP and economic growth.

Increase in regional differences – Population move to the Sunbelt and small towns with their respective differences in climate, value structure, and even occupation will widen the cultural differences by parts of the country. The United States is apt to more closely resemble Europe, where regions vary significantly in terms of growth, employment, Language, and consumption values.

Growing dichotomy between rich and poor – Although we will still have a sizable middle class, the nation will manifest a sharp dichotomy between the rich and poor. A large percentage of the population will be affluent and a sizable group will be below the official poverty level.

Increased stress — The blurring of traditional family roles, increase in autonomy, older age, and need to manage time, all point toward a society that will have higher levels of stress both at home and work.. Stress In turn, will generate productivity issues and behavioral problems, such as drug and alcohol abuse.

Greater concern for privacy — People will become more aware of their lack of privacy and potential loss of individual rights As the social norms of a previously homogeneous society give way to pluralistic and diverse values, we will emphasize legal rights of Individuals.

Emphasis on safety and security — There will be a sharp rise In concern for personal and public safety, partly due to the aging population, and partly due to income redistribution, Additionally, as more people live alone, they will feel more vulnerable. Law enforcement will remain a major social issue.

Entrepreneurial spirit – Opportunities created by the rise in niche markets will encourage personal entrepreneurship. As a result, small businesses will continue as the dominant component of societal change, lit terms of new business formation, employment growth, political power, regulatory policy, and personal wealth.

Expanding Choices

Consumer choices will expand rapidly due to the impact of greater competition and new technologies. For some consumers, cellular already represents a viable alternative to the local and long distance phone companies. The digitalization of cellular services and the widespread deployment of PCS will greatly accelerate this trend. A variety of new wireless services will also become available to consumers. Increasing the ubiquity of computing and communications. Some of the wireless services will rapidly migrate to broadband, presenting an alternative to both the cable W as well as telco wired delivery of information. Consumer choice will also increase through the proliferation of video-on- demand and video-based shopping services.

Implications for Service Providers

A major implication for service providers of the above changes is that they will have to develop an entirely new definition of need. Table 2 gives several examples of the new definition of consumer needs.

What Customers will Demand

Service providers will have to play an active role in creating demand for their new services initially, rather than simply responding to demand as it’s materializes. Utilization levels for even wired telecommunications networks are extremely low: only an average of 30 minutes a day in the U.S., and only about five minutes a day in the U.K. Cellular usage levels are far lower.

As capacities become largely unconstrained in coming years, wireless communication providers will have to create demand for their services.

Telecom companies must develop ways to greatly increase the usage level, first in terms of time spent, then In terms of bits exchanged. In fact, there Is almost no limit to the use of communication technologies; certainly, the limits are far beyond anything that has been approached anywhere thus far. Telecom companies have the great advantage that information technologies in general tend to be highly addictive; once consumers become accustomed to using them and design their work and/or leisure activities around them they are extremely hard to give up. To capitalize on the opportunities available to them to dramatically grow their business, service providers will have to understand not only purchase behavior, but also consumption behavior. By understanding (through the use of focus groups and other qualitative techniques) how a small number of their customers may be using their service highly innovative ways, they can create much larger markets.

The shift from a middle class, homogeneous society to a diverse, rich, poor and highly individualistic society with time poverty, high stress, and tremendous buying power has other significant implications for the telecommunications industry.

The need for better segmentation – First, it will be essential to segment the consumer market and develop specific products and services and offer them cci a targeted basis, In other words, the industry must abandon the shotgun approach in favor of the rifle approach to serving consumer markets. Not only service providers will be committed in this process; equipment suppliers also must understand their customers’ customers if they are to succeed. Consumers in the future will demand and receive personalized attention: segment-of-one marketing, when needed.

Trickle-up technology – Second, a demand for instant access to the world from anywhere and at all times will require faster deployment of the next generation of technologies to consumer markets. Technologies must be not only seamless to the customer, but transparent as well, since they do not have the same degree of technical expertise as business customers.

Focus on customer satisfaction – Finally, future consumers will not only demand reliable products and services that work but will insist on quality support services that are hassle free, convenient, and easy to do business with, The twin processes of customer satisfaction (product quality and customer service) will become key In the future. Their implementation will require an unprecedented partnership effort between service provider and equipment supplier.

Business Markets

Though much of the incremental growth in demand for wireless services will come from consumers, business customers will also demand more services and generate considerable growth.

Large Business Customers

Large business customers will be increasingly globalized, and will thus require uniform global provisioning of advanced services. More and more companies rely on mobile communications as a key competitive weapon. In many industries, these capabilities will become a strategic necessity. The movement to re-engineer business processes In light of available untethered voice and data communications capabilities will accelerate and become much more widespread.

Wireless Data

For traditional phone companies, data transmission revenues are growing at six times the rate of voice traffic, and already represent 20 percent of industry revenues.

According to International Resource Development, a consultancy based in Canaan. Connecticut, the US. market for wireless data and services is already worth over $2 billion a year, and will reach $15 billion by 2000. Consulting Firm Arthur D. Little estimates that, given the opportunity, 40 million Americans in 130 occupations might use wireless communication for eight hours or more per week.

The two dominant providers of mobile data service RAM Mobile Data (partly owned by BellSouth) and Motorola Ardis have both done poorly so far. Past of the reason is that they both use proprietary hardware, with resulting high prices (for example, a modern costs $800). Now they are moving to an open standard to stimulate market growth. The newest entrant, cellular digital packet data (CDPD) Is expected to be much more successful.

Small Business Customers

Small business customers will probably represent the fastest growing segment of the business market. In fact, total employment in firms employing less than 100 employees each now exceeds total employment in Fortune 500 companies. The former numbers growing further, while the latter continues to decline. Small firms lack In-house telecommunications expertise, and are thus far more dependent on service providers. Their unique entrepreneurial culture and lack of bureaucracy make them attractive customers for wireless service providers. Selling wireless services to small business customers will require a different approach. In this case, marketers must lead rather than follow the customer. In other words, it is important to educate customers as to the role this technology can play in their business Doing so requires a depth of expertise and a commitment to consultative relationship marketing.

Markets

We are going global in a wireless world.

-The Financial Times

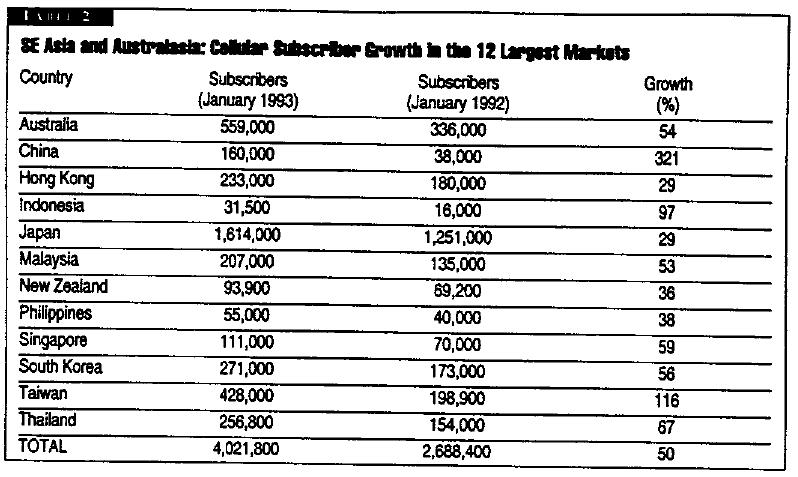

In 1993, the North American cellular market grew 43 percent to 16 million and western Europe grew 47 percent to 8.8 million. By contrast, eastern Europe grew 129 percent (but still only to 110.000), while Malaysia grew by 64 percent, Argentina by 220 percent, and China by 300 percent. China, however, still has barely 700.000 subscribers for one billion people—fewer than Sweden, and only three times more than Switzerland (Figure 7,).10

International Markets

Cellular technology is playing a pivotal role in how people communicate around the world. In 1983, less than 10 countries had cellular systems. By 1968 this number had jumped to about 50 countries and by 1993, there were approximately 140 countries with cellular service, representing the vast majority of the world’s countries. According to EMCI’s report on world cellular markets there will be subscribers worldwide by 1996. The U.S. will account for approximately 45 percent, Western Europe 25 percent, Asia will almost catch up with Western Europe, and Latin America, Africa, Eastern Europe, the Middle East and the Caribbean will account for 5 percent.

In the global market, cellular is clearly not just “a rich man’s by.” It is available in countries with average GNP per capita incomes ranging from $100 to $25,000 In large industrial economies, cellular Is moving from business use to a greater Intensity of consumer use. In lower Income countries, cellular is moving from the wealthy elite to burgeoning middle classes and entrepreneurs As prices for cellular decline, and lower Income counties economically develop cellular will continue to penetrate new market segments. Digital implementation will be particularly important in regions and countries with high demand densities.

In developed economies, cellular is a valuable productivity- enhancing tool and is rapidly evolving into a personal communications service. In developing economies, cellular provides access to telecommunications that is not possible it’s many cases, with misting landline network. EMCI believes that cellular growth will continue to be strong over the next few years, reaching nearly 90 million subscribers by 1998.

The Wireless Local Loop

The technology of the local loop is fundamentally unchanged from the Victorian era.

– George Calhoun

As cellular technology matures, copper is being increasingly recognized as an inefficient way to make the local connect ion. The 130 million lines installed in the US coat between $900 to $1200 each to install. Local phone companies are profitable only because of their ability to write of f this spending over extended periods of time. A wireless link to the local exchange costs less than $1000 and is falling rapidly, unlike the costs of digging up roads, These falling costs, and the rapidity with which wireless technology can be deployed, are increasingly making it viable for phone companies to replace copper with radio (as in Quitaque, Texas), or to forego copper altogether in favor of wireless local access (as in several developing countries). In China, for example, the cost of adding a new wised subscriber Is estimated at over $2000, and numerous cellular protect are underway to provide primary telecommunications services. Likewise, most East European countries have some form of wireless networks most of which are being used in place of conventional telephones.

Investors

Cellular companies have shown poor profitability during this decade of low competition. Most of this is deliberate as they wrote oil their equipment very rapidly. Cellular started Out using 10-year depreciation; many companies later switched to 3-year depredation schedules. They only had to satisfy their auditors, most of whom agreed due to the impending conversion to digital (Figure 8).

Now when PCS comes in, cellular will be able to lower prices dramatically in order to compete.

In the 1983-92 time frame, the market essentially gave the cellular Industry a free ride’; now Investors will demand profitability as well. This may make the cellular industry vulnerable to PCs pricing strategies, which may undermine cellular profitability lust whet investors start expecting dividends.

In the future, investors will expect the industry to generate healthy earnings as well pay dividends. They will also expect today’s cellular providers (especially the larger one) to become more broad-based providers of wireless services, relatively Independent of technology or architecture

Conclusion

The wireless communications Industry clearly has an exciting and explosive future. There is little doubt that the worldwide subscriber base and revenues will grow at double-digit rates or better for the foreseeable future. The challenge will be two-fold: how to become the customer’s choice in an increasingly pluralistic market, and how to operate profitably. A clear understanding of the forces driving competition In the Industry, and dices that promise to transform it in the future, Is a prerequisite to succeeding in 11w marketplace.

End Notes